CWM_LEVEL_2 Exam Question 86

Section B (2 Mark)

The following is not a capital receipt

The following is not a capital receipt

CWM_LEVEL_2 Exam Question 87

Section C (4 Mark)

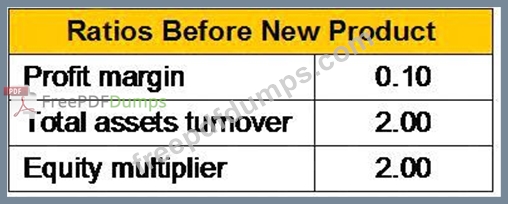

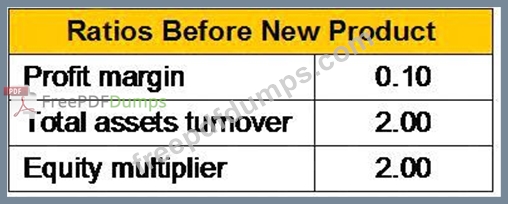

You are considering adding a new product to your firm's existing product line. It should cause a 15 percent increase in your profit margin (i.e., new PM = old PM x 1.15), but it will also require a 50 percent increase in total assets (i.e., new TA = old TA x 1.5). You expect to finance this asset growth entirely by debt. If the following ratios were computed before the change, what will be the new ROE if the new product is added and sales remain constant?

You are considering adding a new product to your firm's existing product line. It should cause a 15 percent increase in your profit margin (i.e., new PM = old PM x 1.15), but it will also require a 50 percent increase in total assets (i.e., new TA = old TA x 1.5). You expect to finance this asset growth entirely by debt. If the following ratios were computed before the change, what will be the new ROE if the new product is added and sales remain constant?

CWM_LEVEL_2 Exam Question 88

Section A (1 Mark)

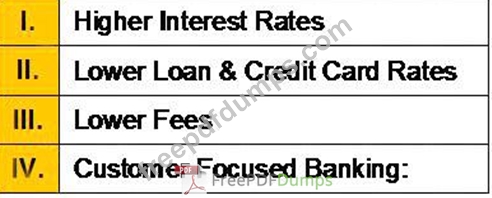

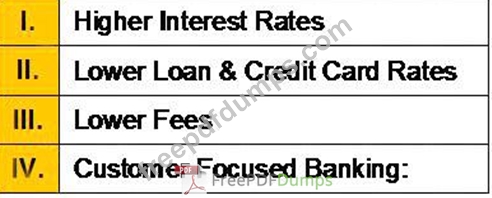

Which of the following are the advantages of a Credit Union:

Which of the following are the advantages of a Credit Union:

CWM_LEVEL_2 Exam Question 89

Section C (4 Mark)

Mr. XYZ is bearish about Nifty and expects it to fall. He sells a Call option with a strike price of Rs. 2600 at a premium of Rs. 154, when the current Nifty is at 2694. If the Nifty stays at 2600 or below, the Call option will not be exercised by the buyer of the Call and Mr. XYZ can retain the entire premium of Rs.154.

What would be the Net Payoff of the Strategy?

* If Nifty closes at 2900

* If Nifty closes at 2400

Mr. XYZ is bearish about Nifty and expects it to fall. He sells a Call option with a strike price of Rs. 2600 at a premium of Rs. 154, when the current Nifty is at 2694. If the Nifty stays at 2600 or below, the Call option will not be exercised by the buyer of the Call and Mr. XYZ can retain the entire premium of Rs.154.

What would be the Net Payoff of the Strategy?

* If Nifty closes at 2900

* If Nifty closes at 2400

CWM_LEVEL_2 Exam Question 90

Section C (4 Mark)

Mr. A bought XYZ Ltd. For Rs. 3850 and simultaneously sells a call option at an strike price of Rs. 4000.

Which means Mr. A does not think that the price of XYZ Ltd. will rise above Rs. 4000. However, incase it rises above Rs. 4000, Mr. A does not mind getting exercised at that price and exiting the stock at Rs. 4000 (Target Sell Price = 3.90% return on the stock purchase price). Mr. A receives a premium of Rs. 80 for selling the call. Thus net outflow to Mr. A is (Rs. 3850 - Rs. 80) = Rs. 3770. He reduces the cost of buying the stock by this strategy.

What would be the Net Payoff of the Strategy?

* If XYZ closes at 3350

* If XYZ closes at 4800

Mr. A bought XYZ Ltd. For Rs. 3850 and simultaneously sells a call option at an strike price of Rs. 4000.

Which means Mr. A does not think that the price of XYZ Ltd. will rise above Rs. 4000. However, incase it rises above Rs. 4000, Mr. A does not mind getting exercised at that price and exiting the stock at Rs. 4000 (Target Sell Price = 3.90% return on the stock purchase price). Mr. A receives a premium of Rs. 80 for selling the call. Thus net outflow to Mr. A is (Rs. 3850 - Rs. 80) = Rs. 3770. He reduces the cost of buying the stock by this strategy.

What would be the Net Payoff of the Strategy?

* If XYZ closes at 3350

* If XYZ closes at 4800