CWM_LEVEL_2 Exam Question 1

Section B (2 Mark)

Mr.Dinesh is transferred to Delhi and is paid a shifting allowance of Rs.20000 by his employers out of which he spends Rs.18000 for shifting his family and personal effects. Which of the following is true?

Mr.Dinesh is transferred to Delhi and is paid a shifting allowance of Rs.20000 by his employers out of which he spends Rs.18000 for shifting his family and personal effects. Which of the following is true?

CWM_LEVEL_2 Exam Question 2

Section C (4 Mark)

Medicon is one the world's largest manufacturer of implantable biomedical devices, reported earnings per share in 1993 of Rs3.95, and paid dividends per share of Rs0.68. Its earnings are expected to grow 16% from

1994 to 1998, but the growth rate is expected to decline each year after that to a stable growth rate of 6% in

2003. The payout ratio is expected to remain unchanged from 1994 to 1998, after which it will increase each year to reach 60% in steady state. The stock is expected to have a beta of 1.25 from 1994 to 1998, after which the beta will decline each year to reach 1.00 by the time the firm becomes stable. (The Risk Free rate is

6.25%.)

Estimate the value per share, using the three-stage dividend discount model.

Medicon is one the world's largest manufacturer of implantable biomedical devices, reported earnings per share in 1993 of Rs3.95, and paid dividends per share of Rs0.68. Its earnings are expected to grow 16% from

1994 to 1998, but the growth rate is expected to decline each year after that to a stable growth rate of 6% in

2003. The payout ratio is expected to remain unchanged from 1994 to 1998, after which it will increase each year to reach 60% in steady state. The stock is expected to have a beta of 1.25 from 1994 to 1998, after which the beta will decline each year to reach 1.00 by the time the firm becomes stable. (The Risk Free rate is

6.25%.)

Estimate the value per share, using the three-stage dividend discount model.

CWM_LEVEL_2 Exam Question 3

Section C (4 Mark)

Read the senario and answer to the question.

If Saxena's debentures have a balance maturity period of 15 years &the coupons are payable annually, what should be the market valuation of these debentures, if risk free interest rate is taken as the required IRR?

Read the senario and answer to the question.

If Saxena's debentures have a balance maturity period of 15 years &the coupons are payable annually, what should be the market valuation of these debentures, if risk free interest rate is taken as the required IRR?

CWM_LEVEL_2 Exam Question 4

Section B (2 Mark)

Which of the following statement is/are correct?

Which of the following statement is/are correct?

CWM_LEVEL_2 Exam Question 5

Section C (4 Mark)

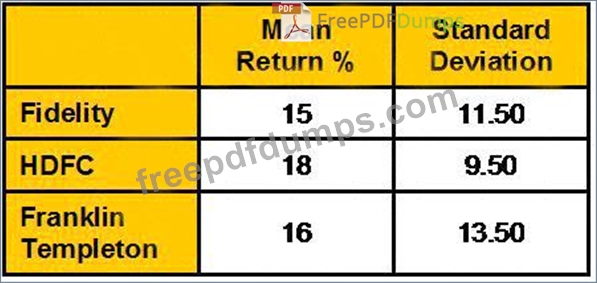

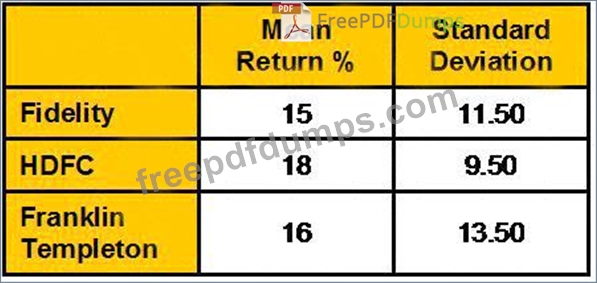

Data on following mutual funds is given below:

Risk free return is 8%. Calculate Sharpe measure.

Data on following mutual funds is given below:

Risk free return is 8%. Calculate Sharpe measure.