CWM_LEVEL_2 Exam Question 241

Section A (1 Mark)

Which of the following income is not exempt under section 10-IT Act 1961?

Which of the following income is not exempt under section 10-IT Act 1961?

CWM_LEVEL_2 Exam Question 242

Section B (2 Mark)

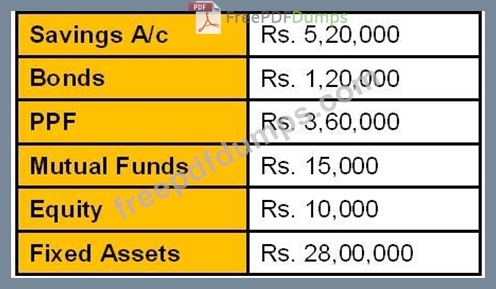

Mahesh wants to sell a property for Rs. 30 lakhs. He is earning rent from tenant Rs. 3,60,000. He is spending following amounts annually on that property.

Based on the above information what should be the value of the property would be:

Mahesh wants to sell a property for Rs. 30 lakhs. He is earning rent from tenant Rs. 3,60,000. He is spending following amounts annually on that property.

Based on the above information what should be the value of the property would be:

CWM_LEVEL_2 Exam Question 243

Section B (2 Mark)

A bank plans to offer new subordinated notes in the open market next month but knows that its credit rating is being reviewed by a credit rating agency. The bank wants to avoid paying sharply higher credit costs. Which type of credit derivative contract would you most recommend for this situation?

A bank plans to offer new subordinated notes in the open market next month but knows that its credit rating is being reviewed by a credit rating agency. The bank wants to avoid paying sharply higher credit costs. Which type of credit derivative contract would you most recommend for this situation?

CWM_LEVEL_2 Exam Question 244

Section A (1 Mark)

Income which accrue or arise outside India but are received directly in India are taxable in case of:

Income which accrue or arise outside India but are received directly in India are taxable in case of:

CWM_LEVEL_2 Exam Question 245

Section C (4 Mark)

A Portfolio manager is holding the following portfolio:

The risk free rate of return is 6% and the portfolio's required rate of return is 12.5%. The manager would like to sell all of his holdings in stock A and use the proceeds to purchase more shares of stock D.

What would be the portfolio's required rate of return following this change?

A Portfolio manager is holding the following portfolio:

The risk free rate of return is 6% and the portfolio's required rate of return is 12.5%. The manager would like to sell all of his holdings in stock A and use the proceeds to purchase more shares of stock D.

What would be the portfolio's required rate of return following this change?