GLO_CWM_LVL_1 Exam Question 81

Mr. Patel expects the stock of A to sell for Rs. 70/- a year from now and to pay Rs. 4/- dividend. If the stock's correlation with the Market is -0.3, and the standard deviation of A is 40% and standard deviation of the Market is 20% and the risk free rate of return is 5% and the market risk premium is 5% , what would be the price of stock A be now ?

GLO_CWM_LVL_1 Exam Question 82

A bank that handles affairs of another bank which has no legal standing in the jurisdiction is called

GLO_CWM_LVL_1 Exam Question 83

The following is an exempt income:

GLO_CWM_LVL_1 Exam Question 84

Ankur Kalra is 33 years old finance professional. The house hold expenditure of Mr. Kalra is 20,000/- p.m. to maintain his current living standard. He assumes that his living standard will increase 1.5% annually until his retirement at 60. His life expectancy is 70 years. At retirement he needs 75% of his last year's expenses.

Inflation rate for the next 45 years is expected to be 4% p.a.

Calculate how much would Mr. Kalra require in the first year after his retirement, and how much he has to save at end of every year to accumulate this corpus, if the return on investment is 7% p.a.?

Inflation rate for the next 45 years is expected to be 4% p.a.

Calculate how much would Mr. Kalra require in the first year after his retirement, and how much he has to save at end of every year to accumulate this corpus, if the return on investment is 7% p.a.?

GLO_CWM_LVL_1 Exam Question 85

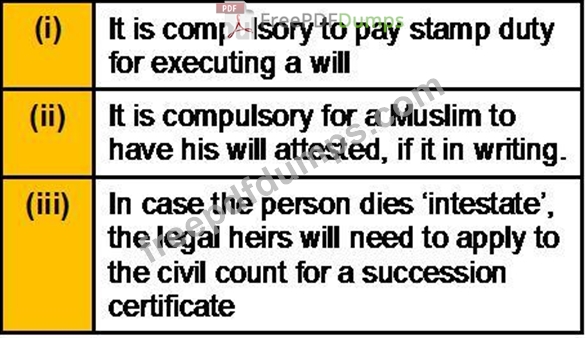

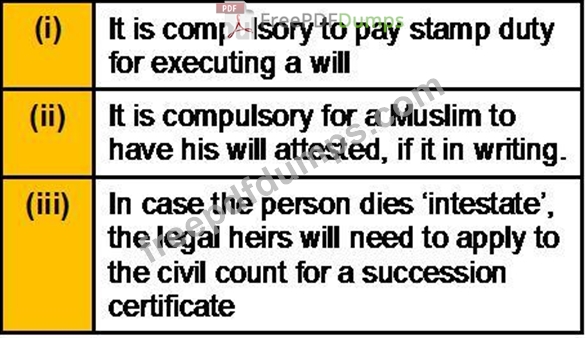

Which one of the following is/are correct?