GLO_CWM_LVL_1 Exam Question 151

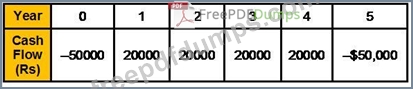

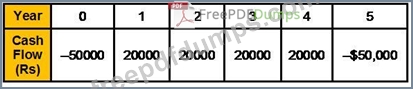

You are considering an investment with the following cash flows. Your required return is 8%, you generally require a payback of 3 years and a discounted payback of 4 years. If your objective is to maximize your wealth, should you take this investment?

GLO_CWM_LVL_1 Exam Question 152

The correlation coefficient between returns on stock of M/s X Ltd and the market returns is 0.3. The variance of returns on M/s X Ltd. is 225(%)2 and that for the market returns is 100(%)2 . The risk-free rate of return is

5% and the market return is 15%. The last paid dividend is Rs. 2 and the current purchase price is Rs. 30. The growth rate for the company is 10%. The required rate of return on the security as per the Capital Asset Pricing Model is:

5% and the market return is 15%. The last paid dividend is Rs. 2 and the current purchase price is Rs. 30. The growth rate for the company is 10%. The required rate of return on the security as per the Capital Asset Pricing Model is:

GLO_CWM_LVL_1 Exam Question 153

Money Laundering:

GLO_CWM_LVL_1 Exam Question 154

Interest on savings bank accounts is paid on _______.

GLO_CWM_LVL_1 Exam Question 155

The following is capital receipt: