GLO_CWM_LVL_1 Exam Question 56

Mahesh earns 1,20,000 pa. He has total debt of Rs. 2,00,000 and have two dependants. Interest rate is 7%, and assumes 80% of his pre-death salary is the estimated requirement to maintain his family after paying the loan.

Calculate the life insurance cover needed under multiple approach method.

Calculate the life insurance cover needed under multiple approach method.

GLO_CWM_LVL_1 Exam Question 57

An inverted yield curve implies that:

GLO_CWM_LVL_1 Exam Question 58

Sachin aged 35 years is married and is working as a manager in M/s Birla Mill Ltd. His most likely retirement age is 60 years. His present salary is Rs. 3,00,000/- pa. His self-maintenance expenses are 30,000/- per year.

Life insurance premium paid is 15,000/-. Income tax & professional tax amount to Rs. 20000/-. Rate of interest assumed for capitalization of future income is 8%. Calculate Sachin's HLV to recommend adequate insurance cover

Life insurance premium paid is 15,000/-. Income tax & professional tax amount to Rs. 20000/-. Rate of interest assumed for capitalization of future income is 8%. Calculate Sachin's HLV to recommend adequate insurance cover

GLO_CWM_LVL_1 Exam Question 59

If, C=Rs.240 million, I = Rs.20 million, G = Rs.90 million, X = Rs.50 million M = Rs.80 million Calculate the value of GDP?

GLO_CWM_LVL_1 Exam Question 60

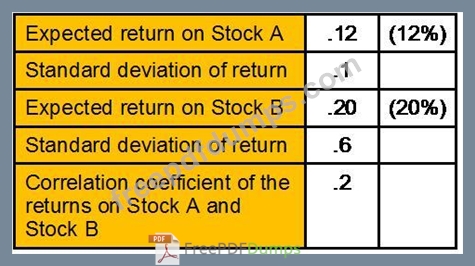

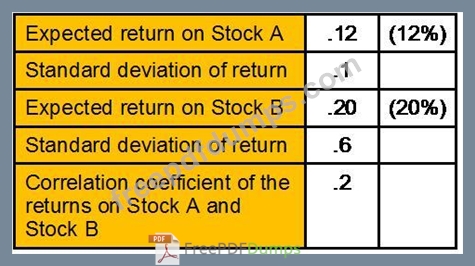

Given the following information:

What is the expected return and standard deviation of the portfolio if 50% of funds invested in each stock?

What would be the impact if the correlation coefficient were 0.6 instead of 0.2?

What is the expected return and standard deviation of the portfolio if 50% of funds invested in each stock?

What would be the impact if the correlation coefficient were 0.6 instead of 0.2?