GLO_CWM_LVL_1 Exam Question 176

Partition can be effected orally & there is no requirement in law that the partition must the evident try a written agreement

GLO_CWM_LVL_1 Exam Question 177

Any amount payable and the amount of refund due under the Income Tax Act,1961 shall be rounded off to the nearest multiple of.......... ?

GLO_CWM_LVL_1 Exam Question 178

Mr. Bose runs his Handicrafts business. His net proceeds after deducting both the business expenses and living expenses are Rs. 6,00,000 p.a, which will increase at the rate of 5%. He is a bachelor and don't intend to start any family in future either. Since he don't have any family obligations, he wants to sell off his business after ten years and buy a home in foothills of Himachal.

He expects to sell the business for a good amount and put 40% of the proceeds in buying the house and setting up a retirement corpus with the rest of amount to pay off his post retirement expenses. He is philanthropic by nature and thus want to save the net revenues from his business to form a charitable hospital for poor people living in Himachal. His current living expenses are Rs. 4,00,000 p.a which will increase in line with inflation.

Inflation rate is 3% and interest rate prevailing is 6%.

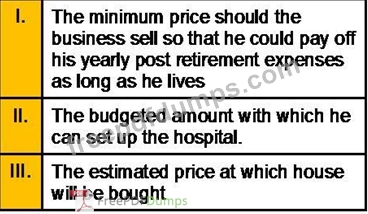

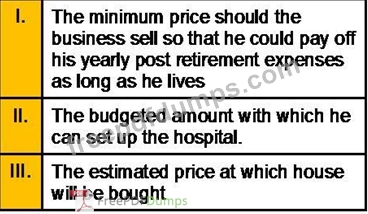

As a CWM you are required to calculate:

He expects to sell the business for a good amount and put 40% of the proceeds in buying the house and setting up a retirement corpus with the rest of amount to pay off his post retirement expenses. He is philanthropic by nature and thus want to save the net revenues from his business to form a charitable hospital for poor people living in Himachal. His current living expenses are Rs. 4,00,000 p.a which will increase in line with inflation.

Inflation rate is 3% and interest rate prevailing is 6%.

As a CWM you are required to calculate:

GLO_CWM_LVL_1 Exam Question 179

A document proposing to be a will which deliberately executed with all due formalities required for a valid will is called:

GLO_CWM_LVL_1 Exam Question 180

Dividends received from investment would be classified as: