GLO_CWM_LVL_1 Exam Question 206

A zero coupon bond of Rs 10,000 has a term to maturity of seven years and a market yield of 9 percent at the time of issue. What is the issue price? What is the duration of the bond? What is the modified duration of the bond?

GLO_CWM_LVL_1 Exam Question 207

Difference between coparceners & member is that coparcener can demand partition of an HUF

GLO_CWM_LVL_1 Exam Question 208

Mr. Rajesh Rawat deposits Rs. 15,000 per month at the end of the month for 6.50 years in an account that pays a ROI of 8.80% per annum compounded quarterly. What will be the amount in the account after 6.50 years.?

GLO_CWM_LVL_1 Exam Question 209

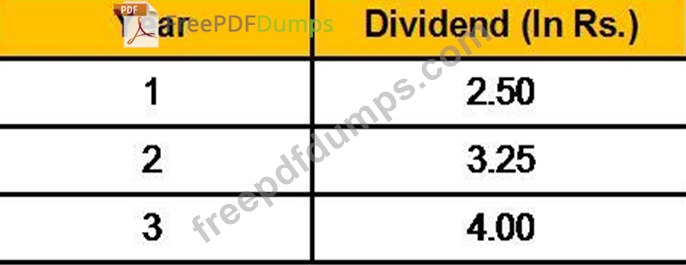

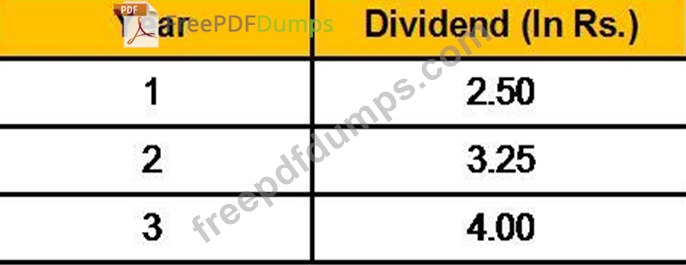

The management of Pearls India Shopping Ltd has recently announced that expected dividends for the next three years will be as follows:

For the remaining years, the management expects the dividend to grow at 5% annually. If the risk-free rate is

4.30%, the return on the market is 10.30% and the firm's beta is 1.40. What is the maximum price that you should pay for this stock?

For the remaining years, the management expects the dividend to grow at 5% annually. If the risk-free rate is

4.30%, the return on the market is 10.30% and the firm's beta is 1.40. What is the maximum price that you should pay for this stock?

GLO_CWM_LVL_1 Exam Question 210

PPF is a

Premium Bundle

Newest GLO_CWM_LVL_1 Exam PDF Dumps shared by Actual4test.com for Helping Passing GLO_CWM_LVL_1 Exam! Actual4test.com now offer the updated GLO_CWM_LVL_1 exam dumps, the Actual4test.com GLO_CWM_LVL_1 exam questions have been updated and answers have been corrected get the latest Actual4test.com GLO_CWM_LVL_1 pdf dumps with Exam Engine here:

(1027 Q&As Dumps, 30%OFF Special Discount: Freepdfdumps)