CFA-Level-I Exam Question 1

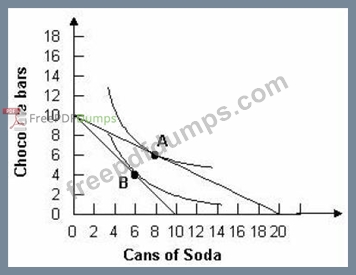

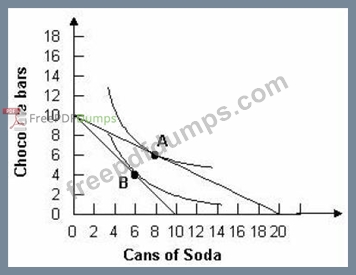

Refer to the graph below. Assuming a consumer has $5 to spend, if a soda costs $0.50 and a chocolate bar costs $0.50, the consumer would optimally choose to consume:

CFA-Level-I Exam Question 2

Which type of indices tends to have the contrarian effect?

CFA-Level-I Exam Question 3

In a descending triangle, the trendline that connects multiple lows during the line:

CFA-Level-I Exam Question 4

An investor is considering building a small office park that she plans to hold for five years before selling. The investor's initial outlay of $250,000 would yield after-tax cash flows in years one through five of $35,000, $38,000, $42,000, $48,000, and $54,000, respectively. It is anticipated that the office park will be sold at the end of the fifth year for net after-tax proceeds of $275,000. If the investor has a required rate of return of 16%, the net present value of this real estate investment would be closest to:

CFA-Level-I Exam Question 5

What is the Net Asset Value of a fund that has the following information?

Total Fund Shares Outstanding: 5,325,000 Total Market Value of Fund: $78,500,000 Portfolio Annual

Fund Expenses: $1,850,000

Total Fund Shares Outstanding: 5,325,000 Total Market Value of Fund: $78,500,000 Portfolio Annual

Fund Expenses: $1,850,000