CFA-Level-I Exam Question 156

The role of the IASB is to

I). formulate international accounting standards.

II). publicize international accounting standards.

III). encourage observance of international accounting standards.

I). formulate international accounting standards.

II). publicize international accounting standards.

III). encourage observance of international accounting standards.

CFA-Level-I Exam Question 157

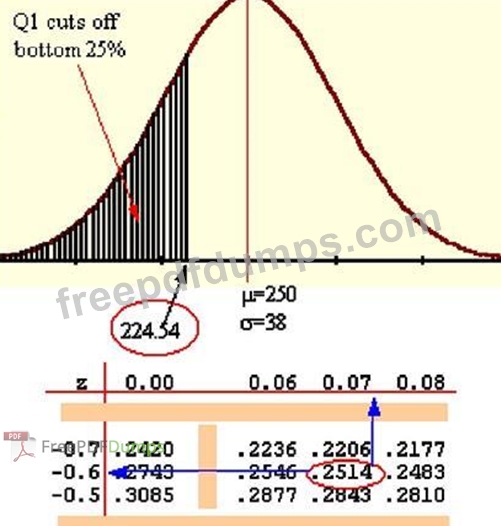

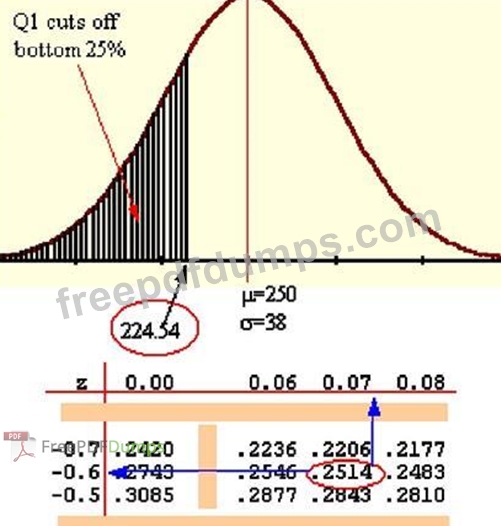

Daily travel expenses for H&J Employees are normally distributed with a mean of $250 and a standard deviation of $38. Q1 for this distribution is ______.

CFA-Level-I Exam Question 158

Assume the risk-free rate is 5%. The expected return on the market portfolio is 12%, and its standard deviation is 20%. A company has an expected return of 18%, a standard deviation of 90% and a correlation of 0.5 with the market. What is the company's Treynor ratio?

CFA-Level-I Exam Question 159

Which of the following statements regarding individual and institutional investors is/are incorrect?

I). Individuals define risk as "losing money", while institutions view risk as variance (or standard deviation) of returns.

II). Individuals are categorized according to their personalities and unique circumstances, whereas institutions are categorized by the investment characteristics of those that have a beneficial interest in the portfolios of pension funds, endowment funds, banks, insurance companies and mutual funds.

III). Individuals are defined financially by their assets and goals (particularly as they related to their life cycle), while institutions are typically concentrated within precise asset and liability parameters.

IV). Institutions have great flexibility in selecting their investments, whereas individuals are managed and regulated by ERISA (Employee Retirement Income Security Act) as well as other legal constraints.

I). Individuals define risk as "losing money", while institutions view risk as variance (or standard deviation) of returns.

II). Individuals are categorized according to their personalities and unique circumstances, whereas institutions are categorized by the investment characteristics of those that have a beneficial interest in the portfolios of pension funds, endowment funds, banks, insurance companies and mutual funds.

III). Individuals are defined financially by their assets and goals (particularly as they related to their life cycle), while institutions are typically concentrated within precise asset and liability parameters.

IV). Institutions have great flexibility in selecting their investments, whereas individuals are managed and regulated by ERISA (Employee Retirement Income Security Act) as well as other legal constraints.

CFA-Level-I Exam Question 160

Empirical studies of mutual fund performance indicate that: