CFA-Level-I Exam Question 221

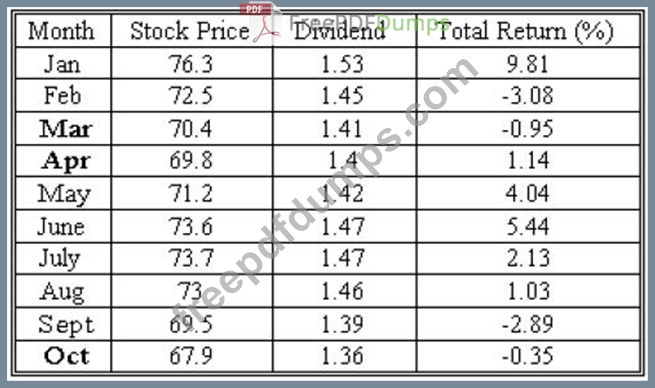

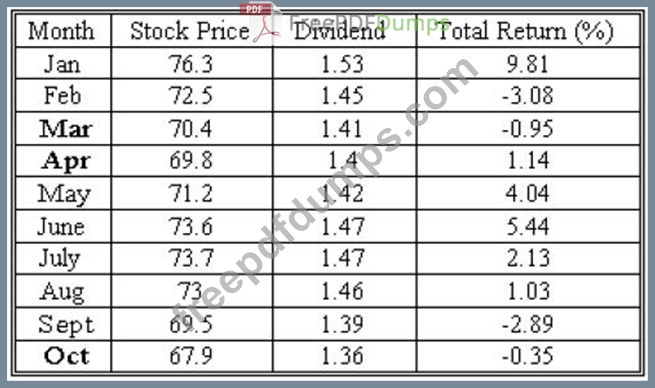

The following table gives the stock price, dividend, and percentage return for 10 months.

If one were to construct a frequency histogram for the stock prices using 3 classes, what percentage of stocks fall in the second stock price interval?

If one were to construct a frequency histogram for the stock prices using 3 classes, what percentage of stocks fall in the second stock price interval?

CFA-Level-I Exam Question 222

The yield to maturity on a bond is:

CFA-Level-I Exam Question 223

In what sense is the mean of any distribution the "best guess" of the score of any single individual selected at random from the group?

I). In a series of such guesses, the sum of the errors in one direction will balance the sum of the errors in the other direction.

II). The mean score will occur more often than any other single score.

III). The chances are 50-50 that any individual will be above or below the mean.

I). In a series of such guesses, the sum of the errors in one direction will balance the sum of the errors in the other direction.

II). The mean score will occur more often than any other single score.

III). The chances are 50-50 that any individual will be above or below the mean.

CFA-Level-I Exam Question 224

Which of the following is/are not current liability as of Dec. 31, 2010?

I). Management fees collected in advance in 2010, to be earned during 2011.

II). The portion of long-term debt due in 2011.

III). Warranty liability for products carrying a two-year warranty and sold during 2010.

IV). The interest due to creditors and bond holders for 2011, to be paid in 2011.

I). Management fees collected in advance in 2010, to be earned during 2011.

II). The portion of long-term debt due in 2011.

III). Warranty liability for products carrying a two-year warranty and sold during 2010.

IV). The interest due to creditors and bond holders for 2011, to be paid in 2011.

CFA-Level-I Exam Question 225

If an effective minimum price is imposed by the government, what would be expected to occur?