CFA-Level-I Exam Question 511

Almost all bonds and currencies trade in:

CFA-Level-I Exam Question 512

The Gaffe Company had net income of $1,500,000. Gaffe paid preferred dividends of $5 on each of the 100,000 preferred shares. Each preferred share is convertible into 20 common shares. There are 1 million Gaffe common shares outstanding. In addition to the common and preferred stock, Gaffe has $25 million of 4 percent bonds outstanding. If Gaffe's tax rate is 40 percent, what is its diluted earnings per share?

CFA-Level-I Exam Question 513

A firm's cost of equity is 12%, which reflects a 4% premium over the cost of its long-term debt. The firm has an EBIT of 27,900 and has 65,000 in debt. The firm is planning to increase its debt by 15,000, which will raise the cost of debt by 1% for the additional amount. What is the change in the company s pre tax profit due to the additional debt?

CFA-Level-I Exam Question 514

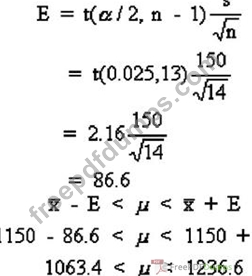

To estimate the average SAT scores for entering freshmen at universities, a random sample of 14

SAT scores is collected. If the sample mean produced a score of 1150 and the sample standard deviation is 150 points (ois unknown) then a 95% confidence interval is _______.

SAT scores is collected. If the sample mean produced a score of 1150 and the sample standard deviation is 150 points (ois unknown) then a 95% confidence interval is _______.

CFA-Level-I Exam Question 515

The staff of a company is 45% female. The probability of a female requesting a sick leave is 12% versus 10% for males. An individual who requested a sick leave was randomly selected from the staff of this company. The probability that this individual is a female would be closest to: