CFA-Level-I Exam Question 121

A Treasury bill with 50-days till maturity is quoted with a bank discount rate of 3.50%. The holding period yield for this T-bill if purchased and held to maturity would be closest to

CFA-Level-I Exam Question 122

Which of the following procedures is not applied when measuring the amount of the deferred tax asset or liability?

CFA-Level-I Exam Question 123

The expected return on the market for next period is 16%. The risk-free rate of return is 6%, and Zebra

Company has a beta that is 20% greater than that for the overall market. The required rate of return for this company is closest to:

Company has a beta that is 20% greater than that for the overall market. The required rate of return for this company is closest to:

CFA-Level-I Exam Question 124

An investment banking department of a brokerage firm often receives material nonpublic information that could have considerable value if used in advising the firm's brokerage clients. In order to conform to the Code and Standards, which of the following is the best policy for the brokerage firm?

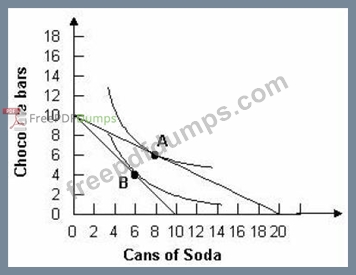

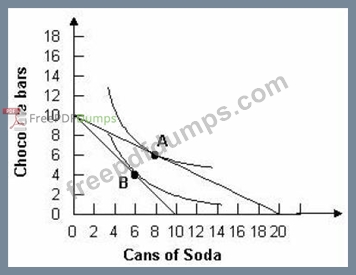

CFA-Level-I Exam Question 125

Refer to the graph below. Assuming a consumer has $5 to spend, if a soda costs $0.50 and a chocolate bar costs $0.50, the consumer would optimally choose to consume: