CFA-Level-I Exam Question 321

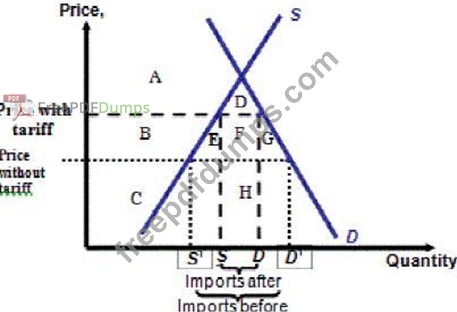

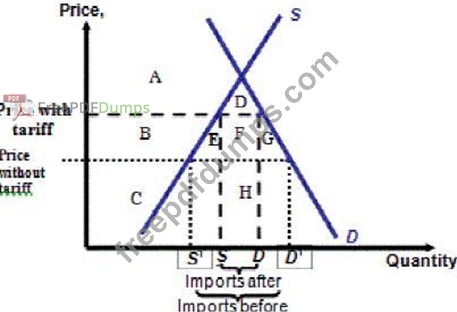

Assume a small country imposes tariff.

After the tariff, the consumer surplus will decrease by: AF

After the tariff, the consumer surplus will decrease by: AF

CFA-Level-I Exam Question 322

The employer's pension expense is the amount that it is obligated to pay to the pension trust in

CFA-Level-I Exam Question 323

In a perfectly competitive market,

CFA-Level-I Exam Question 324

Which of the following statements is (are) valid regarding the interest rate risk for floating rate securities? The price of a floating-rate security will fluctuate because:

I). The longer the time to the next coupon reset date, the greater the potential price fluctuation.

II). The required margin that investors demand in the market changes.

III). A floating-rate security can have a cap.

I). The longer the time to the next coupon reset date, the greater the potential price fluctuation.

II). The required margin that investors demand in the market changes.

III). A floating-rate security can have a cap.

CFA-Level-I Exam Question 325

Calculate an 80% confidence interval for a population mean. You have a sample of 21, a sample mean of 25%, and a sample standard deviation of 10%. The sample appears to be approximately normally distributed.