CIMAPRA19-F03-1 Exam Question 1

Under traditional theory, an increase in a company's WACC would cause the value of the company to:

CIMAPRA19-F03-1 Exam Question 2

A listed company is planning a share repurchase.

The following data applies

* There are 20 million shares in issue

* The share repurchase will involve buying back 10% of the shares at a price of $1.20

* The company is holding $4.8 million cash

* Earnings for the current year ended are $3.6 million

The Directors are concerned about the impact that this repurchase programme will have on the company's cash balance and current year earnings per share (EPS) ratio.

Advise the directors which of the following statements is correct?

The following data applies

* There are 20 million shares in issue

* The share repurchase will involve buying back 10% of the shares at a price of $1.20

* The company is holding $4.8 million cash

* Earnings for the current year ended are $3.6 million

The Directors are concerned about the impact that this repurchase programme will have on the company's cash balance and current year earnings per share (EPS) ratio.

Advise the directors which of the following statements is correct?

CIMAPRA19-F03-1 Exam Question 3

Company W is a manufacturing company with three divisions, all of which are making profits:

* Division A which manufactures cars

* Division B which manufactures trucks

* Division C which manufactures agricultural machinery

Company W is facing severe competitive pressure in all of its markets, and is currently operating with a high level of gearing Company W's latest forecasts suggest that it needs to raise cash to avoid breaching loan covenants on its existing debt finance in 6 months' time In a recent strategy review. Divisions A and B were identified as being the core divisions of Company W The management of Division C is known to be interested in the possibility of a management buy-out.

Company Z is known to be interested in making a takeover bid for Company W's truck manufacturing division A rival to Company W has recently successfully demerged its business, this was well received by the Financial markets Which of the following exit strategies will be most suitable for company W?

* Division A which manufactures cars

* Division B which manufactures trucks

* Division C which manufactures agricultural machinery

Company W is facing severe competitive pressure in all of its markets, and is currently operating with a high level of gearing Company W's latest forecasts suggest that it needs to raise cash to avoid breaching loan covenants on its existing debt finance in 6 months' time In a recent strategy review. Divisions A and B were identified as being the core divisions of Company W The management of Division C is known to be interested in the possibility of a management buy-out.

Company Z is known to be interested in making a takeover bid for Company W's truck manufacturing division A rival to Company W has recently successfully demerged its business, this was well received by the Financial markets Which of the following exit strategies will be most suitable for company W?

CIMAPRA19-F03-1 Exam Question 4

Company A, a listed company, plans to acquire Company T, which is also listed.

Additional information is:

* Company A has 100 million shares in issue, with market price currently at $8.00 per share.

* Company T has 90 million shares in issue,. with market price currently at $5.00 each share.

* Synergies valued at $60 million are expected to arise from the acquisition.

* The terms of the offer will be 2 shares in A for 3 shares in B.

Assuming the offer is accepted and the synergies are realised, what should the post-acquisition price of each of Company A's shares be?

Give your answer to two decimal places.

Additional information is:

* Company A has 100 million shares in issue, with market price currently at $8.00 per share.

* Company T has 90 million shares in issue,. with market price currently at $5.00 each share.

* Synergies valued at $60 million are expected to arise from the acquisition.

* The terms of the offer will be 2 shares in A for 3 shares in B.

Assuming the offer is accepted and the synergies are realised, what should the post-acquisition price of each of Company A's shares be?

Give your answer to two decimal places.

CIMAPRA19-F03-1 Exam Question 5

An aerospace company is planning to diversify into car manufacturing.

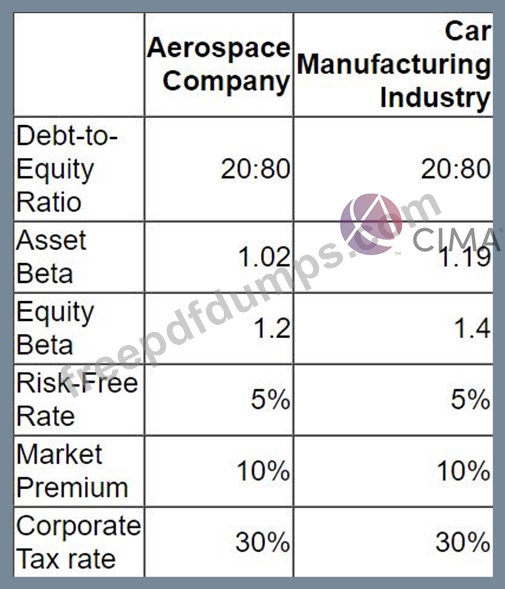

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

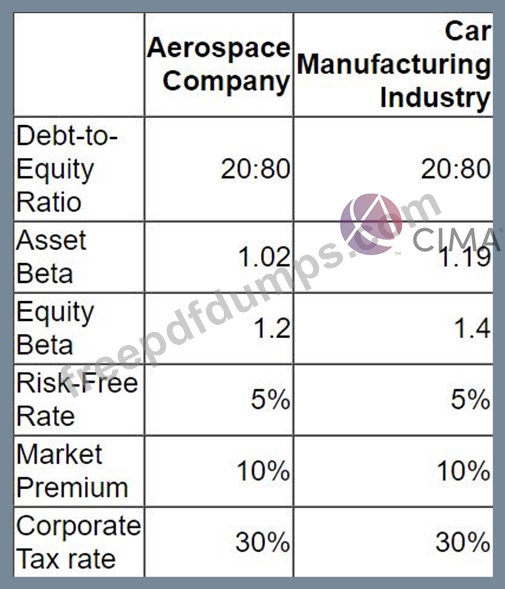

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.