CIMAPRA19-P03-1 Exam Question 36

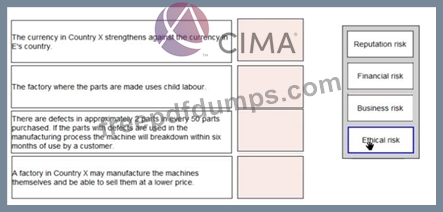

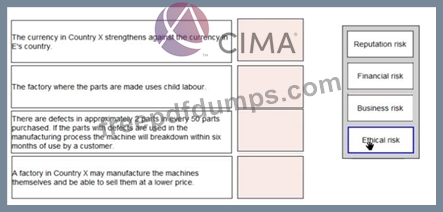

E purchases parts for one of the machines it manufactures from Country X Place the risk classification next to the risk it relates to:

CIMAPRA19-P03-1 Exam Question 37

A capital investment project shows a NPV of £3,450 at a discounted rate of 8% and an NPV of £1,210 at a discounted rate of 9%.

What is the internal rate of return?

What is the internal rate of return?

CIMAPRA19-P03-1 Exam Question 38

W plc is a large international supermarket chain. It has many thousands of suppliers and many thousands of others competing for "shelf space" in its supermarkets.

Which of the following would be appropriate provisions for W plc to include in its Ethical Code in relation to its suppliers?

Which of the following would be appropriate provisions for W plc to include in its Ethical Code in relation to its suppliers?

CIMAPRA19-P03-1 Exam Question 39

CH makes a popular type of chocolate bar The bars are made on a production line and are scanned for size and shape as they move along the line Wrong sized and misshapen bars are rejected as being poor quality. The scanner detects 90% of poor quality bars. If CH wants to reduce the risk of poor quality bars being sold to the public it can add a further check by a person scanning the production line as well. this check would detect 80% of poor quality bars If the further check was implemented what percentage of poor quality bars would still get through the checking process?

CIMAPRA19-P03-1 Exam Question 40

ERT is choosing between two maintenance policies for its vehicles. The outcomes of these policies are difficult to predict and so ERT has run a simu-lation of both.

Policy 1 has an expected annual cost of $400,000 per year, with a standard deviation of $80,000.

Policy 2 has an expected value of $350,000, with a standard deviation of $150,000.

Which of the following statements are correct?

Policy 1 has an expected annual cost of $400,000 per year, with a standard deviation of $80,000.

Policy 2 has an expected value of $350,000, with a standard deviation of $150,000.

Which of the following statements are correct?