F1 Exam Question 1

Which of the following would be capitalized as an intangible asset in accordance with IAS 38 Intangible Assets?

F1 Exam Question 2

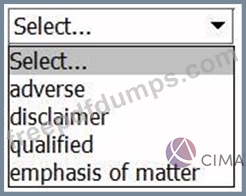

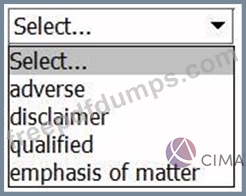

The auditor has identified a material but not pervasive mis-statement whilst undertaking the external audit of an entity's financial statements.

This will result in a modified audit report with the opinion being .

This will result in a modified audit report with the opinion being .

F1 Exam Question 3

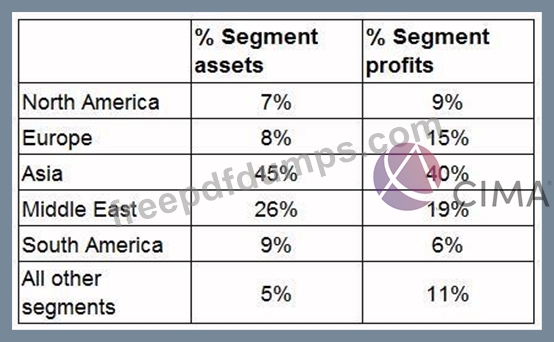

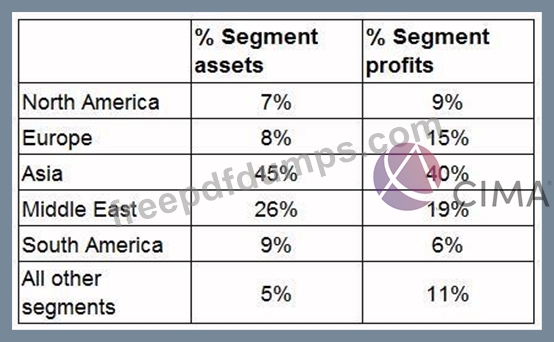

OP has five main geographic segments and reports segmental information in accordance with IFRS 8 Operating Segments.

Which THREE of the following would be regarded as operating segments of OP in accordance with IFRS

8?

Which THREE of the following would be regarded as operating segments of OP in accordance with IFRS

8?

F1 Exam Question 4

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

Calculate gross profit for the year ended 31 December 20X4.

Give your answer as a whole $.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

Calculate gross profit for the year ended 31 December 20X4.

Give your answer as a whole $.

F1 Exam Question 5

Country X levies corporate income tax at a rate of 25% and charges income tax on all profits irrespective of whether they are distributed by way of dividend. Country Y levies corporate income tax at a rate of

20%.

A, who is resident in Country X, pays a divided to B, who is resident in Country Y. B is required to pay corporate income tax on the dividend received from A, but a deduction can be made for the tax suffered on this dividend restricted to a rate of 20%.

Which method of relief for foreign tax does this describe?

20%.

A, who is resident in Country X, pays a divided to B, who is resident in Country Y. B is required to pay corporate income tax on the dividend received from A, but a deduction can be made for the tax suffered on this dividend restricted to a rate of 20%.

Which method of relief for foreign tax does this describe?