F2 Exam Question 16

AB and EF are located in the same country and prepare their financial statements to 31 October in accordance with International Accounting Standards. EF supplies AB with a component that is vital to AB's product range. AB is considering acquiring a controlling interest in EF by 31 December 20X4 in order to guarantee future supply. The Board of EF has indicated that such an approach would be postively considered. AB would use its control to make AB the sole customer of EF.

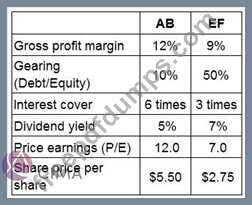

The Finance Director of AB has been granted access to EF's management accounts and has conducted some initial analysis from the financial press. The results togther with comparisons for AB for the year to

31 October 20X4 are presented below:

AB and EF are forecasting revenues of S1,500,000 and $700,000 respectively for the year ended 31 October 20X5.

AB's Finance Director met with one of the directors of EF to discuss the potential impact of the acquisition.

Which of the director's statements below is correct?

The Finance Director of AB has been granted access to EF's management accounts and has conducted some initial analysis from the financial press. The results togther with comparisons for AB for the year to

31 October 20X4 are presented below:

AB and EF are forecasting revenues of S1,500,000 and $700,000 respectively for the year ended 31 October 20X5.

AB's Finance Director met with one of the directors of EF to discuss the potential impact of the acquisition.

Which of the director's statements below is correct?

F2 Exam Question 17

If you were asked to express the overall performance of an entity as a percentage of its total investment in net assets which of the following ratios would you calculate?

F2 Exam Question 18

The basic earning per share computed by a company for year ended 31st March 20X7 is £2 per share.

The company had certain convertible debentures outstanding as on 31st March 20X7. The conversion of debentures to equity shares would result in the earnings per share to be £2.2. Which of the following should the company disclose?

The company had certain convertible debentures outstanding as on 31st March 20X7. The conversion of debentures to equity shares would result in the earnings per share to be £2.2. Which of the following should the company disclose?

F2 Exam Question 19

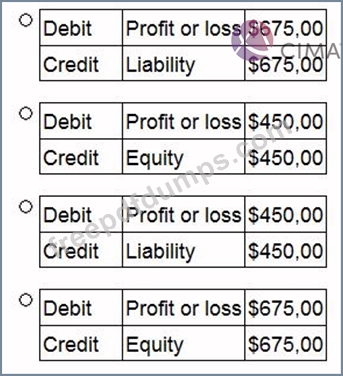

On 1 January 20X4 EF grants each of its 125 employees 500 share options on the condition that they remain in employment for 3 years. During the year to 31 December 20X4 10 employees left and It is expected that a further 25 will leave before the end of the vesting period.

The fair value of each share option is $30 on 1 January 20X4 and $45 on 31 December 20X4.

What is the journal entry in respect of these share options in EF's financial statements for the year ended 31 December 20X4?

The fair value of each share option is $30 on 1 January 20X4 and $45 on 31 December 20X4.

What is the journal entry in respect of these share options in EF's financial statements for the year ended 31 December 20X4?

F2 Exam Question 20

CD commenced a construction contract on 1 April 20X9. The contract value was agreed at $100,000. CD had incurred $40,000 costs to date and estimated costs to completion were $50,000. At the year ended

31 December 20X9 this contract was estimated to be 60% complete. CD adopted the provisions of IAS

11 Construction Contracts when preparing its financial statements for the year to 31 December 20X9.

What value should be included in CD's profit for the year ended 31 December 20X9 in respect of this contract?

Give your answer to the nearest whole number.

$ ?

31 December 20X9 this contract was estimated to be 60% complete. CD adopted the provisions of IAS

11 Construction Contracts when preparing its financial statements for the year to 31 December 20X9.

What value should be included in CD's profit for the year ended 31 December 20X9 in respect of this contract?

Give your answer to the nearest whole number.

$ ?