F3 Exam Question 1

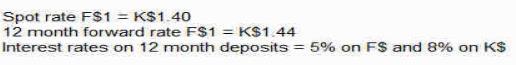

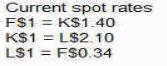

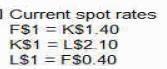

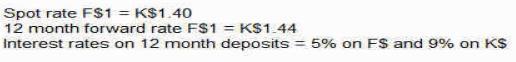

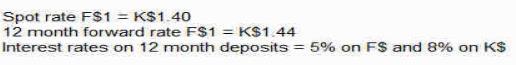

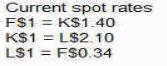

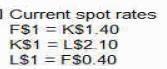

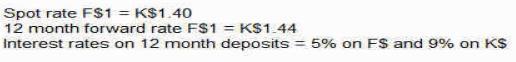

Which TWO of the following situations offer arbitrage opportunities?

A)

B)

C)

D)

A)

B)

C)

D)

F3 Exam Question 2

A company is located in a single country. The company manufactures electrical goods for export and for sale in its home country. When exporting, it invoices in its customers' currency. What currency risks is the company exposed to?

F3 Exam Question 3

An entity prepares financial statements to 30 June.

During the year ended 30 June 20X2 the following events occurred:

1 July 20X1

* The entitiy borrowed $100 million at a variable rate of interest.

* In order to protect itself against the variability of its interest cashflows, the entity entered into a pay-fixed-receive-variable interest swap with annual settlements. The fair value of the swap on this date was zero.

30 June 20X2

* The entity received a net settlement of $2 million under the swap. After this net settlement, the fair value of the swap was $5 million - a financial asset.

The entity decides to use hedge accounting for this arrangement and has designated it as a cash flow hedge.

The swap is a perfect hedge of the variability of the cash interest payments.

Which of the following describes the treatment of the settlement and the change in the fair value of the swap in the statement of profit or loss and other comprehensive income for the year ended 30 June 20X2?

During the year ended 30 June 20X2 the following events occurred:

1 July 20X1

* The entitiy borrowed $100 million at a variable rate of interest.

* In order to protect itself against the variability of its interest cashflows, the entity entered into a pay-fixed-receive-variable interest swap with annual settlements. The fair value of the swap on this date was zero.

30 June 20X2

* The entity received a net settlement of $2 million under the swap. After this net settlement, the fair value of the swap was $5 million - a financial asset.

The entity decides to use hedge accounting for this arrangement and has designated it as a cash flow hedge.

The swap is a perfect hedge of the variability of the cash interest payments.

Which of the following describes the treatment of the settlement and the change in the fair value of the swap in the statement of profit or loss and other comprehensive income for the year ended 30 June 20X2?

F3 Exam Question 4

Company A needs to raise AS500 mi lion to invest in a new project and is considering using a pub ic issue of bonds to finance the investment.

Which THREE of the following statements-relating to this bond issue are true?

Which THREE of the following statements-relating to this bond issue are true?

F3 Exam Question 5

A listed company plans to raise $350 million to finance a major expansion programme.

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of

3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of

3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?