P1 Exam Question 1

A company's budget for the next period shows that it would breakeven at sales revenue of $800,000 and fixed costs of $320,000.

The sales revenue needed to achieve a profit of $200,000 in the next period would be:

The sales revenue needed to achieve a profit of $200,000 in the next period would be:

P1 Exam Question 2

A medium-sized manufacturing company, which operates in the electronics industry, has employed a firm of consultants to carry out a review of the company's planning and control systems. The company presently uses a traditional incremental budgeting system and the inventory management system is based on economic order quantities (EOQ) and reorder levels. The company's normal production patterns have changed significantly over the previous few years as a result of increasing demand for customized products. This has resulted in shorter production runs and difficulties with production and resource planning.

The consultants have recommended the implementation of activity based budgeting and a manufacturing resource planning system to improve planning and resource management.

How will a manufacturing resource planning system improve the planning of purchases and production for the company?

Select ALL the correct answers.

The consultants have recommended the implementation of activity based budgeting and a manufacturing resource planning system to improve planning and resource management.

How will a manufacturing resource planning system improve the planning of purchases and production for the company?

Select ALL the correct answers.

P1 Exam Question 3

A company accountant is trying to determine the optimum production plan for the period using linear programming.

The accountant has correctly formulated the linear programming problem as follows:

Variables (products): x and y

Objective function: Maximise contribution, C = 10x + 15y

Material constraint: 4x + 6y ≤ 500 (kg)

Labour constraint: x + 2y ≤ 350 (hours)

Machine constraint: 10x + 4y ≤ 1,500 (hours)

x constraint: 50 ≤ x ≤ 200

y constraint: y ≥ 0

Which of the following statements is true?

The accountant has correctly formulated the linear programming problem as follows:

Variables (products): x and y

Objective function: Maximise contribution, C = 10x + 15y

Material constraint: 4x + 6y ≤ 500 (kg)

Labour constraint: x + 2y ≤ 350 (hours)

Machine constraint: 10x + 4y ≤ 1,500 (hours)

x constraint: 50 ≤ x ≤ 200

y constraint: y ≥ 0

Which of the following statements is true?

P1 Exam Question 4

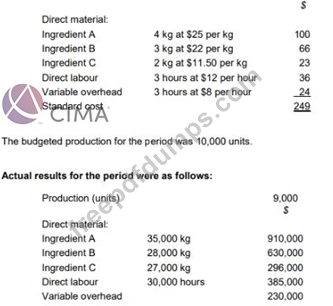

TP makes wedding cakes that are sold to specialist retail outlets which decorate the cakes according to the customers' specific requirements. The standard cost per unit of its most popular cake is as follows:

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and

$20 per kg respectively. TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

What was the material price planning variance for ingredient B?

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and

$20 per kg respectively. TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

What was the material price planning variance for ingredient B?

P1 Exam Question 5

Product G has the following sales information:

If moving averages of annual sales over 3-year periods are calculated, what is the moving average at Year 3?

If moving averages of annual sales over 3-year periods are calculated, what is the moving average at Year 3?