P2 Exam Question 31

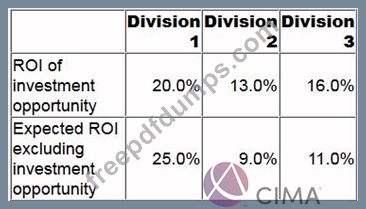

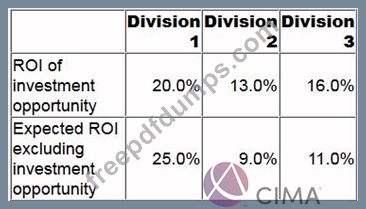

A company has three divisions, each of which is an investment centre. The divisional managers' performance is assessed using return on investment (ROI). A higher ROI will result in a higher bonus for the divisional manager.

The company's cost of capital is 15%.

For the forthcoming year each divisional manager has one investment opportunity available as follows:

The manager(s) of which division(s) will proceed with their respective investment opportunity?

The company's cost of capital is 15%.

For the forthcoming year each divisional manager has one investment opportunity available as follows:

The manager(s) of which division(s) will proceed with their respective investment opportunity?

P2 Exam Question 32

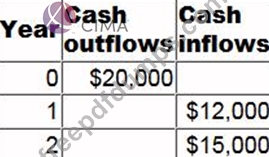

The following cash flows are forecast for a potential investment project.

The cost of capital for the project is 12% per year and the company uses a straight line depreciation policy.

What is the modified internal rate of return (MIRR) of the project?

Give your answer to the nearest whole percentage.

The cost of capital for the project is 12% per year and the company uses a straight line depreciation policy.

What is the modified internal rate of return (MIRR) of the project?

Give your answer to the nearest whole percentage.

P2 Exam Question 33

An 80% learning curve will apply to the production of a new product. The first unit will require 120 labor hours. The labor rate is $11 per hour.

To the nearest $1, the expected total labor cost for the first 4 units is:

To the nearest $1, the expected total labor cost for the first 4 units is:

P2 Exam Question 34

A positive net present value (NPV) has been calculated for a project to launch a new product. An additional calculation is required to identify the sensitivity of the NPV to changes in the forecast total sales volume.

The present value of which of the following would be used in the calculation?

The present value of which of the following would be used in the calculation?

P2 Exam Question 35

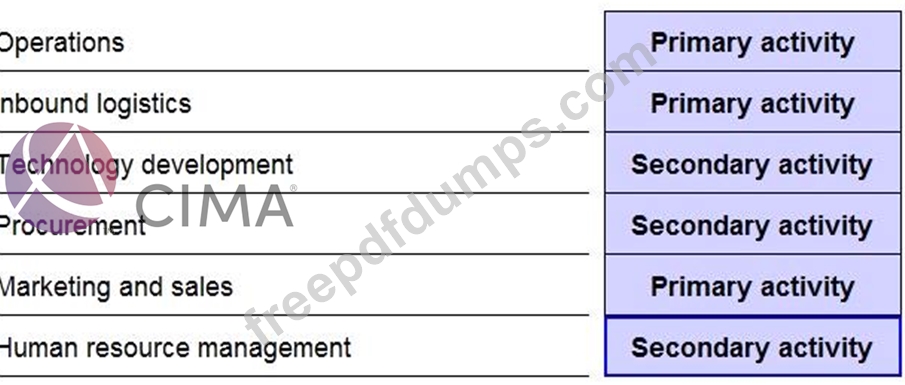

Place the correct category of Value Chain activity against each of the activities described below.