L5M4 Exam Question 1

Peter is looking to put together a contract for the construction of a new house. Describe 3 different pricing mechanisms he could use and the advantages and disadvantages of each. (25 marks)

Correct Answer:

See the answer in Explanation below:

Explanation:

Pricing mechanisms in contracts define how payments are structured between the buyer (Peter) and the contractor for the construction of the new house. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, selecting an appropriate pricing mechanism is crucial for managing costs, allocating risks, and ensuring value for money in construction contracts. Below are three pricing mechanisms Peter could use, along with their advantages and disadvantages, explained in detail:

* Fixed Price (Lump Sum) Contract:

* Description: A fixed price contract sets a single, predetermined price for the entire project, agreed upon before work begins. The contractor is responsible for delivering the house within this budget, regardless of actual costs incurred.

* Advantages:

* Cost Certainty for Peter: Peter knows the exact cost upfront, aiding financial planning and budgeting.

* Example: If the fixed price is £200k, Peter can plan his finances without worrying about cost overruns.

* Motivates Efficiency: The contractor is incentivized to control costs and complete the project efficiently to maximize profit.

* Example: The contractor might optimize material use to stay within the £200k budget.

* Disadvantages:

* Risk of Low Quality: To stay within budget, the contractor might cut corners, compromising the house's quality.

* Example: Using cheaper materials to save costs could lead to structural issues.

* Inflexibility for Changes: Any changes to the house design (e.g., adding a room) may lead to costly variations or disputes.

* Example: Peter's request for an extra bathroom might significantly increase the price beyond the original £200k.

* Cost-Reimbursable (Cost-Plus) Contract:

* Description: The contractor is reimbursed for all allowable costs incurred during construction (e.

g., labor, materials), plus an additional fee (either a fixed amount or a percentage of costs) as profit.

* Advantages:

* Flexibility for Changes: Peter can make design changes without major disputes, as costs are adjusted accordingly.

* Example: Adding a new feature like a skylight can be accommodated with cost adjustments.

* Encourages Quality: The contractor has less pressure to cut corners since costs are covered, potentially leading to a higher-quality house.

* Example: The contractor might use premium materials, knowing expenses will be reimbursed.

* Disadvantages:

* Cost Uncertainty for Peter: Total costs are unknown until the project ends, posing a financial risk to Peter.

* Example: Costs might escalate from an estimated £180k to £250k due to unexpected expenses.

* Less Incentive for Efficiency: The contractor may lack motivation to control costs, as they are reimbursed regardless, potentially inflating expenses.

* Example: The contractor might overstaff the project, increasing labor costs unnecessarily.

* Time and Materials (T&M) Contract:

* Description: The contractor is paid based on the time spent (e.g., hourly labor rates) and materials used, often with a cap or "not-to-exceed" clause to limit total costs. This mechanism is common for projects with uncertain scopes.

* Advantages:

* Flexibility for Scope Changes: Suitable for construction projects where the final design may evolve, allowing Peter to adjust plans mid-project.

* Example: If Peter decides to change the layout midway, the contractor can adapt without major renegotiation.

* Transparency in Costs: Peter can see detailed breakdowns of labor and material expenses, ensuring clarity in spending.

* Example: Peter receives itemized bills showing £5k for materials and £3k for labor each month.

* Disadvantages:

* Cost Overrun Risk: Without a strict cap, costs can spiral if the project takes longer or requires more materials than expected.

* Example: A delay due to weather might increase labor costs beyond the budget.

* Requires Close Monitoring: Peter must actively oversee the project to prevent inefficiencies or overbilling by the contractor.

* Example: The contractor might overstate hours worked, requiring Peter to verify timesheets.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide dedicates significant attention to pricing mechanisms in contracts, particularly in the context of financial management and risk allocation. It identifies pricing structures like fixed price, cost-reimbursable, and time and materials as key methods to balance cost control, flexibility, and quality in contracts, such as Peter's construction project. The guide emphasizes that the choice of pricing mechanism impacts "financial risk, cost certainty, and contractor behavior," aligning with L5M4's focus on achieving value for money.

* Detailed Explanation of Each Pricing Mechanism:

* Fixed Price (Lump Sum) Contract:

* The guide describes fixed price contracts as providing "cost certainty for the buyer" but warns of risks like "quality compromise" if contractors face cost pressures. For Peter, this mechanism ensures he knows the exact cost (£200k), but he must specify detailed requirements upfront to avoid disputes over changes.

* Financial Link: L5M4 highlights that fixed pricing supports budget adherence but requires robust risk management (e.g., quality inspections) to prevent cost savings at the expense of quality.

* Cost-Reimbursable (Cost-Plus) Contract:

* The guide notes that cost-plus contracts offer "flexibility for uncertain scopes" but shift cost risk to the buyer. For Peter, this means he can adjust the house design, but he must monitor costs closely to avoid overruns.

* Practical Consideration: The guide advises setting a maximum cost ceiling or defining allowable costs to mitigate the risk of escalation, ensuring financial control.

* Time and Materials (T&M) Contract:

* L5M4 identifies T&M contracts as suitable for "projects with undefined scopes," offering transparency but requiring "active oversight." For Peter, thismechanism suits a construction project with potential design changes, but he needs to manage the contractor to prevent inefficiencies.

* Risk Management: The guide recommends including a not-to-exceed clause to cap costs, aligning with financial management principles of cost control.

* Application to Peter's Scenario:

* Fixed Price: Best if Peter has a clear, unchanging design for the house, ensuring cost certainty but requiring strict quality checks.

* Cost-Reimbursable: Ideal if Peter anticipates design changes (e.g., adding features), but he must set cost limits to manage financial risk.

* Time and Materials: Suitable if the project scope is uncertain, offering flexibility but demanding Peter's involvement to monitor costs and progress.

* Peter should choose based on his priorities: cost certainty (Fixed Price), flexibility (Cost- Reimbursable), or transparency (T&M).

* Broader Implications:

* The guide stresses aligning the pricing mechanism with project complexity and risk tolerance.

For construction, where scope changes are common, a hybrid approach (e.g., fixed price with allowances for variations) might balance cost and flexibility.

* Financially, the choice impacts Peter's budget and risk exposure. Fixed price minimizes financial risk but may compromise quality, while cost-plus and T&M require careful oversight to ensure value for money, a core L5M4 principle.

Explanation:

Pricing mechanisms in contracts define how payments are structured between the buyer (Peter) and the contractor for the construction of the new house. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, selecting an appropriate pricing mechanism is crucial for managing costs, allocating risks, and ensuring value for money in construction contracts. Below are three pricing mechanisms Peter could use, along with their advantages and disadvantages, explained in detail:

* Fixed Price (Lump Sum) Contract:

* Description: A fixed price contract sets a single, predetermined price for the entire project, agreed upon before work begins. The contractor is responsible for delivering the house within this budget, regardless of actual costs incurred.

* Advantages:

* Cost Certainty for Peter: Peter knows the exact cost upfront, aiding financial planning and budgeting.

* Example: If the fixed price is £200k, Peter can plan his finances without worrying about cost overruns.

* Motivates Efficiency: The contractor is incentivized to control costs and complete the project efficiently to maximize profit.

* Example: The contractor might optimize material use to stay within the £200k budget.

* Disadvantages:

* Risk of Low Quality: To stay within budget, the contractor might cut corners, compromising the house's quality.

* Example: Using cheaper materials to save costs could lead to structural issues.

* Inflexibility for Changes: Any changes to the house design (e.g., adding a room) may lead to costly variations or disputes.

* Example: Peter's request for an extra bathroom might significantly increase the price beyond the original £200k.

* Cost-Reimbursable (Cost-Plus) Contract:

* Description: The contractor is reimbursed for all allowable costs incurred during construction (e.

g., labor, materials), plus an additional fee (either a fixed amount or a percentage of costs) as profit.

* Advantages:

* Flexibility for Changes: Peter can make design changes without major disputes, as costs are adjusted accordingly.

* Example: Adding a new feature like a skylight can be accommodated with cost adjustments.

* Encourages Quality: The contractor has less pressure to cut corners since costs are covered, potentially leading to a higher-quality house.

* Example: The contractor might use premium materials, knowing expenses will be reimbursed.

* Disadvantages:

* Cost Uncertainty for Peter: Total costs are unknown until the project ends, posing a financial risk to Peter.

* Example: Costs might escalate from an estimated £180k to £250k due to unexpected expenses.

* Less Incentive for Efficiency: The contractor may lack motivation to control costs, as they are reimbursed regardless, potentially inflating expenses.

* Example: The contractor might overstaff the project, increasing labor costs unnecessarily.

* Time and Materials (T&M) Contract:

* Description: The contractor is paid based on the time spent (e.g., hourly labor rates) and materials used, often with a cap or "not-to-exceed" clause to limit total costs. This mechanism is common for projects with uncertain scopes.

* Advantages:

* Flexibility for Scope Changes: Suitable for construction projects where the final design may evolve, allowing Peter to adjust plans mid-project.

* Example: If Peter decides to change the layout midway, the contractor can adapt without major renegotiation.

* Transparency in Costs: Peter can see detailed breakdowns of labor and material expenses, ensuring clarity in spending.

* Example: Peter receives itemized bills showing £5k for materials and £3k for labor each month.

* Disadvantages:

* Cost Overrun Risk: Without a strict cap, costs can spiral if the project takes longer or requires more materials than expected.

* Example: A delay due to weather might increase labor costs beyond the budget.

* Requires Close Monitoring: Peter must actively oversee the project to prevent inefficiencies or overbilling by the contractor.

* Example: The contractor might overstate hours worked, requiring Peter to verify timesheets.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide dedicates significant attention to pricing mechanisms in contracts, particularly in the context of financial management and risk allocation. It identifies pricing structures like fixed price, cost-reimbursable, and time and materials as key methods to balance cost control, flexibility, and quality in contracts, such as Peter's construction project. The guide emphasizes that the choice of pricing mechanism impacts "financial risk, cost certainty, and contractor behavior," aligning with L5M4's focus on achieving value for money.

* Detailed Explanation of Each Pricing Mechanism:

* Fixed Price (Lump Sum) Contract:

* The guide describes fixed price contracts as providing "cost certainty for the buyer" but warns of risks like "quality compromise" if contractors face cost pressures. For Peter, this mechanism ensures he knows the exact cost (£200k), but he must specify detailed requirements upfront to avoid disputes over changes.

* Financial Link: L5M4 highlights that fixed pricing supports budget adherence but requires robust risk management (e.g., quality inspections) to prevent cost savings at the expense of quality.

* Cost-Reimbursable (Cost-Plus) Contract:

* The guide notes that cost-plus contracts offer "flexibility for uncertain scopes" but shift cost risk to the buyer. For Peter, this means he can adjust the house design, but he must monitor costs closely to avoid overruns.

* Practical Consideration: The guide advises setting a maximum cost ceiling or defining allowable costs to mitigate the risk of escalation, ensuring financial control.

* Time and Materials (T&M) Contract:

* L5M4 identifies T&M contracts as suitable for "projects with undefined scopes," offering transparency but requiring "active oversight." For Peter, thismechanism suits a construction project with potential design changes, but he needs to manage the contractor to prevent inefficiencies.

* Risk Management: The guide recommends including a not-to-exceed clause to cap costs, aligning with financial management principles of cost control.

* Application to Peter's Scenario:

* Fixed Price: Best if Peter has a clear, unchanging design for the house, ensuring cost certainty but requiring strict quality checks.

* Cost-Reimbursable: Ideal if Peter anticipates design changes (e.g., adding features), but he must set cost limits to manage financial risk.

* Time and Materials: Suitable if the project scope is uncertain, offering flexibility but demanding Peter's involvement to monitor costs and progress.

* Peter should choose based on his priorities: cost certainty (Fixed Price), flexibility (Cost- Reimbursable), or transparency (T&M).

* Broader Implications:

* The guide stresses aligning the pricing mechanism with project complexity and risk tolerance.

For construction, where scope changes are common, a hybrid approach (e.g., fixed price with allowances for variations) might balance cost and flexibility.

* Financially, the choice impacts Peter's budget and risk exposure. Fixed price minimizes financial risk but may compromise quality, while cost-plus and T&M require careful oversight to ensure value for money, a core L5M4 principle.

L5M4 Exam Question 2

What tools are available for buyers to help procure items on the commodities market? (25 points)

Correct Answer:

See the answer in Explanation below:

Explanation:

Buyers in the commodities market can use various tools to manage procurement effectively, mitigating risks like price volatility. Below are three tools, detailed step-by-step:

* Futures Contracts

* Step 1: Understand the ToolAgreements to buy/sell a commodity at a set price on a future date, traded on exchanges.

* Step 2: ApplicationA buyer locks in a price for copper delivery in 6 months, hedging against price rises.

* Step 3: BenefitsProvides cost certainty and protection from volatility.

* Use for Buyers:Ensures predictable budgeting for raw materials.

* Options Contracts

* Step 1: Understand the ToolGives the right (not obligation) to buy/sell a commodity at a fixed price before a deadline.

* Step 2: ApplicationA buyer purchases an option to buy oil at $70/barrel, exercising it if prices exceed this.

* Step 3: BenefitsLimits downside risk while allowing gains from favorable price drops.

* Use for Buyers:Offers flexibility in volatile markets.

* Commodity Price Indices

* Step 1: Understand the ToolBenchmarks tracking average commodity prices (e.g., CRB Index, S&P GSCI).

* Step 2: ApplicationBuyers monitor indices to time purchases or negotiate contracts based on trends.

* Step 3: BenefitsEnhances market intelligence for strategic buying decisions.

* Use for Buyers:Helps optimize procurement timing and pricing.

Exact Extract Explanation:

The CIPS L5M4 Study Guide details these tools for commodity procurement:

* Futures Contracts:"Futures allow buyers to hedge against price increases, securing supply at a known cost" (CIPS L5M4 Study Guide, Chapter 6, Section 6.3).

* Options Contracts:"Options provide flexibility, protecting against adverse price movements while retaining upside potential" (CIPS L5M4 Study Guide, Chapter 6, Section 6.3).

* Price Indices:"Indices offer real-time data, aiding buyers in timing purchases and benchmarking costs" (CIPS L5M4 Study Guide, Chapter 6, Section 6.4).These tools are critical for managing commodity market risks. References: CIPS L5M4 Study Guide, Chapter 6: Commodity Markets and Procurement.

Explanation:

Buyers in the commodities market can use various tools to manage procurement effectively, mitigating risks like price volatility. Below are three tools, detailed step-by-step:

* Futures Contracts

* Step 1: Understand the ToolAgreements to buy/sell a commodity at a set price on a future date, traded on exchanges.

* Step 2: ApplicationA buyer locks in a price for copper delivery in 6 months, hedging against price rises.

* Step 3: BenefitsProvides cost certainty and protection from volatility.

* Use for Buyers:Ensures predictable budgeting for raw materials.

* Options Contracts

* Step 1: Understand the ToolGives the right (not obligation) to buy/sell a commodity at a fixed price before a deadline.

* Step 2: ApplicationA buyer purchases an option to buy oil at $70/barrel, exercising it if prices exceed this.

* Step 3: BenefitsLimits downside risk while allowing gains from favorable price drops.

* Use for Buyers:Offers flexibility in volatile markets.

* Commodity Price Indices

* Step 1: Understand the ToolBenchmarks tracking average commodity prices (e.g., CRB Index, S&P GSCI).

* Step 2: ApplicationBuyers monitor indices to time purchases or negotiate contracts based on trends.

* Step 3: BenefitsEnhances market intelligence for strategic buying decisions.

* Use for Buyers:Helps optimize procurement timing and pricing.

Exact Extract Explanation:

The CIPS L5M4 Study Guide details these tools for commodity procurement:

* Futures Contracts:"Futures allow buyers to hedge against price increases, securing supply at a known cost" (CIPS L5M4 Study Guide, Chapter 6, Section 6.3).

* Options Contracts:"Options provide flexibility, protecting against adverse price movements while retaining upside potential" (CIPS L5M4 Study Guide, Chapter 6, Section 6.3).

* Price Indices:"Indices offer real-time data, aiding buyers in timing purchases and benchmarking costs" (CIPS L5M4 Study Guide, Chapter 6, Section 6.4).These tools are critical for managing commodity market risks. References: CIPS L5M4 Study Guide, Chapter 6: Commodity Markets and Procurement.

L5M4 Exam Question 3

What are KPIs and why are they used? Give examples.

Correct Answer:

See the answer in Explanation below:

Explanation:

Key Performance Indicators (KPIs) are quantifiable metrics used to evaluate the success of an organization, project, or individual in meeting predefined objectives. Within the scope of the CIPS L5M4 Advanced Contract and Financial Management module, KPIs play a pivotal role in monitoring and managing contract performance, ensuring financial efficiency, and delivering value for money. They provide a structured framework to assess whether contractual obligations are being fulfilled and whether financial and operational goals are on track. KPIs are used to enhance transparency, foster accountability, support decision-making, and drive continuous improvement by identifying strengths and weaknesses in performance. Below is a detailed step-by-step solution:

* Definition of KPIs:

* KPIs are specific, measurable indicators that reflect progress toward strategic or operational goals.

* They differ from general metrics by being directly tied to critical success factors in a contract or financial context.

* Characteristics of Effective KPIs:

* Specific: Clearly defined to avoid ambiguity (e.g., "on-time delivery" rather than "good service").

* Measurable: Quantifiable in numerical terms (e.g., percentage, cost, time).

* Achievable: Realistic within the contract's scope and resources.

* Relevant: Aligned with the contract's purpose and organizational goals.

* Time-bound: Measured within a specific timeframe (e.g., monthly, quarterly).

* Why KPIs Are Used:

* Performance Monitoring: Track supplier or contractor adherence to agreed terms.

* Risk Management: Identify deviations early to mitigate potential issues (e.g., delays or cost overruns).

* Financial Control: Ensure budgets are adhered to and cost efficiencies are achieved.

* Accountability: Hold parties responsible for meeting agreed standards.

* Continuous Improvement: Provide data to refine processes and enhance future contracts.

* Examples of KPIs:

* Operational KPI:Percentage of On-Time Deliveries- Measures the supplier's ability to deliver goods or services within agreed timelines (e.g., 98% of shipments delivered on schedule).

* Financial KPI:Cost Variance- Compares actual costs to budgeted costs (e.g., staying within 5% of the allocated budget).

* Quality KPI:Defect Rate- Tracks the proportion of defective items or services (e.g., less than 1% defects in a production batch).

* Service KPI:Response Time- Evaluates how quickly a supplier addresses issues (e.g., resolving complaints within 24 hours).

* Sustainability KPI:Carbon Footprint Reduction- Measures environmental impact (e.g., 10% reduction in emissions from logistics).

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide positions KPIs as a cornerstone of effective contract management. According to the guide, KPIs are "quantifiable measures that allow organizations to assess supplier performance against contractual obligations and financial targets." They are not arbitrary metrics but are carefully selected to reflect the contract's priorities, such as cost efficiency, quality, or timely delivery. The guide stresses that KPIs must be agreed upon by all parties during the contract negotiation phase to ensure mutual understanding and commitment.

* Detailed Purpose:

* Monitoring and Evaluation: Chapter 2 of the study guide explains that KPIs provide "a systematic approach to monitoring performance," enabling managers to track progress in real- time and compare it against benchmarks. For example, a KPI like "percentage of invoices paid on time" ensures financial discipline.

* Decision-Making: KPIs offer data-driven insights, allowing contract managers to decide whether to escalate issues, renegotiate terms, or terminate agreements. The guide notes, "KPIs highlight variances that require corrective action."

* Value for Money: The financial management aspect of L5M4 emphasizes KPIs as tools to ensure contracts deliver economic benefits. For instance, a KPI tracking "total cost of ownership" helps assess long-term savings beyond initial costs.

* Risk Mitigation: By setting thresholds (e.g., maximum acceptable delay), KPIs act as early warning systems, aligning with the guide's focus on proactive risk management.

* Practical Application:

* The guide provides examples like "schedule performance index" (SPI), which measures progress against timelines, and "cost performance index" (CPI), which evaluates budget efficiency. These are often expressed as ratios (e.g., SPI > 1 indicates ahead of schedule).

* Another example is "service level agreements" (SLAs), where KPIs such as "uptime percentage" (e.g., 99.9% system availability) are critical in IT contracts.

* In a procurement context, KPIs like "supplier lead time" (e.g., goods delivered within 7 days) ensure supply chain reliability.

* Why They Matter:

* The study guide underscores that KPIs bridge the gap between contract terms and actual outcomes. They transform abstract goals (e.g., "improve quality") into concrete targets (e.g.,

"reduce defects by 15%"). This alignment is vital for achieving strategic objectives, such as cost reduction or customer satisfaction.

* KPIs also facilitate stakeholder communication by providing a common language to discuss performance. For instance, a KPI report showing "90% compliance with safety standards" reassures clients and regulators alike.

* Broader Implications:

* In complex contracts, KPIs may be tiered (e.g., primary KPIs for overall success and secondary KPIs for specific tasks). The guide advises balancing quantitative KPIs (e.g., cost savings) with qualitative ones (e.g., customer feedback scores) to capture a holistic view.

* Regular review of KPIs is recommended to adapt to changing circumstances, such as market fluctuations or new regulations, ensuring they remain relevant throughout the contract lifecycle.

Explanation:

Key Performance Indicators (KPIs) are quantifiable metrics used to evaluate the success of an organization, project, or individual in meeting predefined objectives. Within the scope of the CIPS L5M4 Advanced Contract and Financial Management module, KPIs play a pivotal role in monitoring and managing contract performance, ensuring financial efficiency, and delivering value for money. They provide a structured framework to assess whether contractual obligations are being fulfilled and whether financial and operational goals are on track. KPIs are used to enhance transparency, foster accountability, support decision-making, and drive continuous improvement by identifying strengths and weaknesses in performance. Below is a detailed step-by-step solution:

* Definition of KPIs:

* KPIs are specific, measurable indicators that reflect progress toward strategic or operational goals.

* They differ from general metrics by being directly tied to critical success factors in a contract or financial context.

* Characteristics of Effective KPIs:

* Specific: Clearly defined to avoid ambiguity (e.g., "on-time delivery" rather than "good service").

* Measurable: Quantifiable in numerical terms (e.g., percentage, cost, time).

* Achievable: Realistic within the contract's scope and resources.

* Relevant: Aligned with the contract's purpose and organizational goals.

* Time-bound: Measured within a specific timeframe (e.g., monthly, quarterly).

* Why KPIs Are Used:

* Performance Monitoring: Track supplier or contractor adherence to agreed terms.

* Risk Management: Identify deviations early to mitigate potential issues (e.g., delays or cost overruns).

* Financial Control: Ensure budgets are adhered to and cost efficiencies are achieved.

* Accountability: Hold parties responsible for meeting agreed standards.

* Continuous Improvement: Provide data to refine processes and enhance future contracts.

* Examples of KPIs:

* Operational KPI:Percentage of On-Time Deliveries- Measures the supplier's ability to deliver goods or services within agreed timelines (e.g., 98% of shipments delivered on schedule).

* Financial KPI:Cost Variance- Compares actual costs to budgeted costs (e.g., staying within 5% of the allocated budget).

* Quality KPI:Defect Rate- Tracks the proportion of defective items or services (e.g., less than 1% defects in a production batch).

* Service KPI:Response Time- Evaluates how quickly a supplier addresses issues (e.g., resolving complaints within 24 hours).

* Sustainability KPI:Carbon Footprint Reduction- Measures environmental impact (e.g., 10% reduction in emissions from logistics).

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide positions KPIs as a cornerstone of effective contract management. According to the guide, KPIs are "quantifiable measures that allow organizations to assess supplier performance against contractual obligations and financial targets." They are not arbitrary metrics but are carefully selected to reflect the contract's priorities, such as cost efficiency, quality, or timely delivery. The guide stresses that KPIs must be agreed upon by all parties during the contract negotiation phase to ensure mutual understanding and commitment.

* Detailed Purpose:

* Monitoring and Evaluation: Chapter 2 of the study guide explains that KPIs provide "a systematic approach to monitoring performance," enabling managers to track progress in real- time and compare it against benchmarks. For example, a KPI like "percentage of invoices paid on time" ensures financial discipline.

* Decision-Making: KPIs offer data-driven insights, allowing contract managers to decide whether to escalate issues, renegotiate terms, or terminate agreements. The guide notes, "KPIs highlight variances that require corrective action."

* Value for Money: The financial management aspect of L5M4 emphasizes KPIs as tools to ensure contracts deliver economic benefits. For instance, a KPI tracking "total cost of ownership" helps assess long-term savings beyond initial costs.

* Risk Mitigation: By setting thresholds (e.g., maximum acceptable delay), KPIs act as early warning systems, aligning with the guide's focus on proactive risk management.

* Practical Application:

* The guide provides examples like "schedule performance index" (SPI), which measures progress against timelines, and "cost performance index" (CPI), which evaluates budget efficiency. These are often expressed as ratios (e.g., SPI > 1 indicates ahead of schedule).

* Another example is "service level agreements" (SLAs), where KPIs such as "uptime percentage" (e.g., 99.9% system availability) are critical in IT contracts.

* In a procurement context, KPIs like "supplier lead time" (e.g., goods delivered within 7 days) ensure supply chain reliability.

* Why They Matter:

* The study guide underscores that KPIs bridge the gap between contract terms and actual outcomes. They transform abstract goals (e.g., "improve quality") into concrete targets (e.g.,

"reduce defects by 15%"). This alignment is vital for achieving strategic objectives, such as cost reduction or customer satisfaction.

* KPIs also facilitate stakeholder communication by providing a common language to discuss performance. For instance, a KPI report showing "90% compliance with safety standards" reassures clients and regulators alike.

* Broader Implications:

* In complex contracts, KPIs may be tiered (e.g., primary KPIs for overall success and secondary KPIs for specific tasks). The guide advises balancing quantitative KPIs (e.g., cost savings) with qualitative ones (e.g., customer feedback scores) to capture a holistic view.

* Regular review of KPIs is recommended to adapt to changing circumstances, such as market fluctuations or new regulations, ensuring they remain relevant throughout the contract lifecycle.

L5M4 Exam Question 4

ABC Ltd wishes to implement a new communication plan with various stakeholders. How could ABC go about doing this? (25 points)

Correct Answer:

See the answer in Explanation below:

Explanation:

To implement a new communication plan with stakeholders, ABC Ltd can follow a structured approach to ensure clarity, engagement, and effectiveness. Below is a step-by-step process:

* Identify Stakeholders and Their Needs

* Step 1: Stakeholder MappingUse tools like the Power-Interest Matrix to categorize stakeholders (e.g., employees, suppliers, customers) based on influence and interest.

* Step 2: Assess NeedsDetermine communication preferences (e.g., suppliers may need contract updates, employees may want operational news).

* Outcome:Tailors the plan to specific stakeholder requirements.

* Define Objectives and Key Messages

* Step 1: Set GoalsEstablish clear aims (e.g., improve supplier collaboration, enhance customer trust).

* Step 2: Craft MessagesDevelop concise, relevant messages aligned with objectives (e.g., "We're streamlining procurement for faster delivery").

* Outcome:Ensures consistent, purpose-driven communication.

* Select Communication Channels

* Step 1: Match Channels to StakeholdersChoose appropriate methods: emails for formal updates, meetings for key partners, social media for customers.

* Step 2: Ensure AccessibilityUse multiple platforms (e.g., newsletters, webinars) to reach diverse groups.

* Outcome:Maximizes reach and engagement.

* Implement and Monitor the Plan

* Step 1: Roll OutLaunch the plan with a timeline (e.g., weekly supplier briefings, monthly staff updates).

* Step 2: Gather FeedbackUse surveys or discussions to assess effectiveness and adjust as needed.

* Outcome:Ensures the plan remains relevant and impactful.

Exact Extract Explanation:

The CIPS L5M4 Study Guide emphasizes structured communication planning:

* "Effective communication requires identifying stakeholders, setting clear objectives, selecting appropriate channels, and monitoring outcomes" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8). It stresses tailoring approaches to stakeholder needs and using feedback for refinement, critical for procurement and contract management. References: CIPS L5M4 Study Guide, Chapter 1:

Organizational Objectives and Financial Management.===========

Explanation:

To implement a new communication plan with stakeholders, ABC Ltd can follow a structured approach to ensure clarity, engagement, and effectiveness. Below is a step-by-step process:

* Identify Stakeholders and Their Needs

* Step 1: Stakeholder MappingUse tools like the Power-Interest Matrix to categorize stakeholders (e.g., employees, suppliers, customers) based on influence and interest.

* Step 2: Assess NeedsDetermine communication preferences (e.g., suppliers may need contract updates, employees may want operational news).

* Outcome:Tailors the plan to specific stakeholder requirements.

* Define Objectives and Key Messages

* Step 1: Set GoalsEstablish clear aims (e.g., improve supplier collaboration, enhance customer trust).

* Step 2: Craft MessagesDevelop concise, relevant messages aligned with objectives (e.g., "We're streamlining procurement for faster delivery").

* Outcome:Ensures consistent, purpose-driven communication.

* Select Communication Channels

* Step 1: Match Channels to StakeholdersChoose appropriate methods: emails for formal updates, meetings for key partners, social media for customers.

* Step 2: Ensure AccessibilityUse multiple platforms (e.g., newsletters, webinars) to reach diverse groups.

* Outcome:Maximizes reach and engagement.

* Implement and Monitor the Plan

* Step 1: Roll OutLaunch the plan with a timeline (e.g., weekly supplier briefings, monthly staff updates).

* Step 2: Gather FeedbackUse surveys or discussions to assess effectiveness and adjust as needed.

* Outcome:Ensures the plan remains relevant and impactful.

Exact Extract Explanation:

The CIPS L5M4 Study Guide emphasizes structured communication planning:

* "Effective communication requires identifying stakeholders, setting clear objectives, selecting appropriate channels, and monitoring outcomes" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8). It stresses tailoring approaches to stakeholder needs and using feedback for refinement, critical for procurement and contract management. References: CIPS L5M4 Study Guide, Chapter 1:

Organizational Objectives and Financial Management.===========

L5M4 Exam Question 5

Explain three different types of financial data you could collect on a supplier and what this data would tell you (25 marks)

Correct Answer:

See the answer in Explanation below:

Explanation:

Collecting financial data on a supplier is a critical step in supplier evaluation, ensuring they are financially stable and capable of fulfilling contractual obligations. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, analyzing financial data helps mitigate risks, supports strategic sourcing decisions, and ensures value for money in contracts. Below are three types of financial data, their purpose, and what they reveal about a supplier, explained in detail:

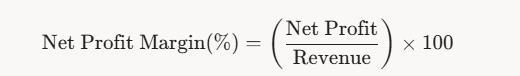

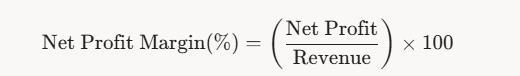

* Profitability Ratios (e.g., Net Profit Margin):

* Description: Profitability ratios measure a supplier's ability to generate profit from its operations. Net Profit Margin, for example, is calculated as:

A math equation with numbers and symbols AI-generated content may be incorrect.

* This data is typically found in the supplier's income statement.

* What It Tells You:

* Indicates the supplier's financial health and efficiency in managing costs. A high margin (e.g.,

15%) suggests strong profitability and resilience, while a low or negative margin (e.g., 2% or

-5%) signals potential financial distress.

* Helps assess if the supplier can sustain operations without passing excessive costs to the buyer.

* Example: A supplier with a 10% net profit margin is likely stable, but a declining margin over years might indicate rising costs or inefficiencies, posing a risk to contract delivery.

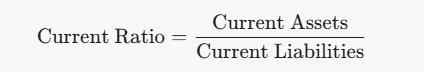

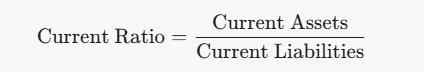

Liquidity Ratios (e.g., Current Ratio):

* Description: Liquidity ratios assess a supplier's ability to meet short-term obligations. The Current Ratio is calculated as:

A black text on a white background AI-generated content may be incorrect.

* This data is sourced from the supplier's balance sheet.

* What It Tells You:

* Shows whether the supplier can pay its debts as they come due. A ratio above 1 (e.g., 1.5) indicates good liquidity, while a ratio below 1 (e.g., 0.8) suggests potential cash flow issues.

* A low ratio may signal risk of delays or failure to deliver due to financial constraints.

* Example: A supplier with a Current Ratio of 2.0 can comfortably cover short-term liabilities, reducing the risk of supply disruptions for the buyer.

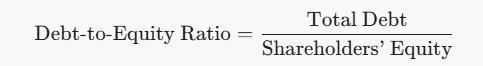

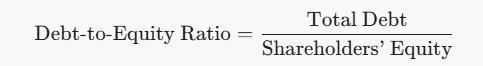

Debt-to-Equity Ratio:

* Description: This ratio measures a supplier's financial leverage by comparing its total debt to shareholders' equity:

A math equation with black text AI-generated content may be incorrect.

* This data is also found in the balance sheet.

* What It Tells You:

* Indicates the supplier's reliance on debt financing. A high ratio (e.g., 2.0) suggests heavy borrowing, increasing financial risk, while a low ratio (e.g., 0.5) indicates stability.

* A high ratio may mean the supplier is vulnerable to interest rate hikes or economic downturns, risking insolvency.

* Example: A supplier with a Debt-to-Equity Ratio of 0.3 is financially stable, while one with a ratio of 3.0 might struggle to meet obligations if market conditions worsen.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes the importance of financial due diligence in supplier selection and risk management, directly addressing the need to collect and analyze financial data. It highlights that "assessing a supplier's financial stability is critical to ensuring contract performance and mitigating risks," particularly in strategic or long-term contracts. The guide specifically references financial ratios as tools to evaluate supplier health, aligning with the types of data above.

* Detailed Explanation of Each Type of Data:

* Profitability Ratios (e.g., Net Profit Margin):

* The guide notes that profitability metrics like Net Profit Margin "provide insight into a supplier's operational efficiency and financial sustainability." A supplier with consistent or growing margins is likely to maintain quality and delivery standards, supporting contract reliability.

* Application: For XYZ Ltd (Question 7), a raw material supplier with a declining margin might cut corners on quality to save costs, risking production issues. L5M4 stresses that profitability data helps buyers predict long-term supplier viability, ensuring financial value.

* Liquidity Ratios (e.g., Current Ratio):

* Chapter 4 of the study guide highlights liquidity as a "key indicator of short-term financial health." A supplier with poor liquidity might delay deliveries or fail to fulfill orders, directly impacting the buyer's operations and costs.

* Practical Use: A Current Ratio below 1 might prompt XYZ Ltd to negotiate stricter payment terms or seek alternative suppliers, aligning with L5M4's focus on risk mitigation.

The guide advises using liquidity data to avoid over-reliance on financially weak suppliers.

* Debt-to-Equity Ratio:

* The guide identifies leverage ratios like Debt-to-Equity as measures of "financial risk exposure." A high ratio indicates potential instability, which could lead to supply chain disruptions if the supplier faces financial distress.

* Relevance: For a manufacturer like XYZ Ltd, a supplier with a high Debt-to-Equity Ratio might be a risk during economic downturns, as they may struggle to access credit for production. The guide recommends using this data to assess long-term partnership potential, a key financial management principle.

* Broader Implications:

* The guide advises combining these financial metrics for a comprehensive view. For example, a supplier with high profitability but poor liquidity might be profitable but unable to meet short- term obligations, posing a contract risk.

* Financial data should be tracked over time (e.g., 3-5 years) to identify trends-e.g., a rising Debt- to-Equity Ratio might signal increasing risk, even if current figures seem acceptable.

* In L5M4's financial management context, this data ensures cost control by avoiding suppliers likely to fail, which could lead to costly delays or the need to source alternatives at higher prices.

* Practical Application for XYZ Ltd:

* Profitability: A supplier with a 12% Net Profit Margin indicates stability, but XYZ Ltd should monitor for declines.

* Liquidity: A Current Ratio of 1.8 suggests the supplier can meet obligations, reducing delivery risks.

* Debt-to-Equity: A ratio of 0.4 shows low leverage, making the supplier a safer long-term partner.

* Together, these metrics help XYZ Ltd select a financially sound supplier, ensuring contract performance and financial efficiency.

Explanation:

Collecting financial data on a supplier is a critical step in supplier evaluation, ensuring they are financially stable and capable of fulfilling contractual obligations. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, analyzing financial data helps mitigate risks, supports strategic sourcing decisions, and ensures value for money in contracts. Below are three types of financial data, their purpose, and what they reveal about a supplier, explained in detail:

* Profitability Ratios (e.g., Net Profit Margin):

* Description: Profitability ratios measure a supplier's ability to generate profit from its operations. Net Profit Margin, for example, is calculated as:

A math equation with numbers and symbols AI-generated content may be incorrect.

* This data is typically found in the supplier's income statement.

* What It Tells You:

* Indicates the supplier's financial health and efficiency in managing costs. A high margin (e.g.,

15%) suggests strong profitability and resilience, while a low or negative margin (e.g., 2% or

-5%) signals potential financial distress.

* Helps assess if the supplier can sustain operations without passing excessive costs to the buyer.

* Example: A supplier with a 10% net profit margin is likely stable, but a declining margin over years might indicate rising costs or inefficiencies, posing a risk to contract delivery.

Liquidity Ratios (e.g., Current Ratio):

* Description: Liquidity ratios assess a supplier's ability to meet short-term obligations. The Current Ratio is calculated as:

A black text on a white background AI-generated content may be incorrect.

* This data is sourced from the supplier's balance sheet.

* What It Tells You:

* Shows whether the supplier can pay its debts as they come due. A ratio above 1 (e.g., 1.5) indicates good liquidity, while a ratio below 1 (e.g., 0.8) suggests potential cash flow issues.

* A low ratio may signal risk of delays or failure to deliver due to financial constraints.

* Example: A supplier with a Current Ratio of 2.0 can comfortably cover short-term liabilities, reducing the risk of supply disruptions for the buyer.

Debt-to-Equity Ratio:

* Description: This ratio measures a supplier's financial leverage by comparing its total debt to shareholders' equity:

A math equation with black text AI-generated content may be incorrect.

* This data is also found in the balance sheet.

* What It Tells You:

* Indicates the supplier's reliance on debt financing. A high ratio (e.g., 2.0) suggests heavy borrowing, increasing financial risk, while a low ratio (e.g., 0.5) indicates stability.

* A high ratio may mean the supplier is vulnerable to interest rate hikes or economic downturns, risking insolvency.

* Example: A supplier with a Debt-to-Equity Ratio of 0.3 is financially stable, while one with a ratio of 3.0 might struggle to meet obligations if market conditions worsen.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes the importance of financial due diligence in supplier selection and risk management, directly addressing the need to collect and analyze financial data. It highlights that "assessing a supplier's financial stability is critical to ensuring contract performance and mitigating risks," particularly in strategic or long-term contracts. The guide specifically references financial ratios as tools to evaluate supplier health, aligning with the types of data above.

* Detailed Explanation of Each Type of Data:

* Profitability Ratios (e.g., Net Profit Margin):

* The guide notes that profitability metrics like Net Profit Margin "provide insight into a supplier's operational efficiency and financial sustainability." A supplier with consistent or growing margins is likely to maintain quality and delivery standards, supporting contract reliability.

* Application: For XYZ Ltd (Question 7), a raw material supplier with a declining margin might cut corners on quality to save costs, risking production issues. L5M4 stresses that profitability data helps buyers predict long-term supplier viability, ensuring financial value.

* Liquidity Ratios (e.g., Current Ratio):

* Chapter 4 of the study guide highlights liquidity as a "key indicator of short-term financial health." A supplier with poor liquidity might delay deliveries or fail to fulfill orders, directly impacting the buyer's operations and costs.

* Practical Use: A Current Ratio below 1 might prompt XYZ Ltd to negotiate stricter payment terms or seek alternative suppliers, aligning with L5M4's focus on risk mitigation.

The guide advises using liquidity data to avoid over-reliance on financially weak suppliers.

* Debt-to-Equity Ratio:

* The guide identifies leverage ratios like Debt-to-Equity as measures of "financial risk exposure." A high ratio indicates potential instability, which could lead to supply chain disruptions if the supplier faces financial distress.

* Relevance: For a manufacturer like XYZ Ltd, a supplier with a high Debt-to-Equity Ratio might be a risk during economic downturns, as they may struggle to access credit for production. The guide recommends using this data to assess long-term partnership potential, a key financial management principle.

* Broader Implications:

* The guide advises combining these financial metrics for a comprehensive view. For example, a supplier with high profitability but poor liquidity might be profitable but unable to meet short- term obligations, posing a contract risk.

* Financial data should be tracked over time (e.g., 3-5 years) to identify trends-e.g., a rising Debt- to-Equity Ratio might signal increasing risk, even if current figures seem acceptable.

* In L5M4's financial management context, this data ensures cost control by avoiding suppliers likely to fail, which could lead to costly delays or the need to source alternatives at higher prices.

* Practical Application for XYZ Ltd:

* Profitability: A supplier with a 12% Net Profit Margin indicates stability, but XYZ Ltd should monitor for declines.

* Liquidity: A Current Ratio of 1.8 suggests the supplier can meet obligations, reducing delivery risks.

* Debt-to-Equity: A ratio of 0.4 shows low leverage, making the supplier a safer long-term partner.

* Together, these metrics help XYZ Ltd select a financially sound supplier, ensuring contract performance and financial efficiency.

- Latest Upload

- 107Salesforce.ADM-201.v2025-09-06.q260

- 104Oracle.1Z0-1055-23.v2025-09-06.q48

- 104Cisco.010-151.v2025-09-06.q130

- 130PMI.PMI-PBA.v2025-09-05.q160

- 139Salesforce.Advanced-Cross-Channel.v2025-09-04.q41

- 133EC-COUNCIL.312-40.v2025-09-04.q87

- 148Oracle.1Z1-591.v2025-09-03.q129

- 128Oracle.1z0-1065-25.v2025-09-03.q26

- 162Cisco.350-701.v2025-09-03.q218

- 126Oracle.1Z0-1195-25.v2025-09-03.q20