L6M2 Exam Question 1

SIMULATION

XYX is an airline whose profits have been severely affected due to not being able to operate during a two-year pandemic. Cash reserves at the organisation are at an all time low and XYZ are looking into sources of short-term funding for working capital. Discuss four sources and suggest which one XYZ should use.

XYX is an airline whose profits have been severely affected due to not being able to operate during a two-year pandemic. Cash reserves at the organisation are at an all time low and XYZ are looking into sources of short-term funding for working capital. Discuss four sources and suggest which one XYZ should use.

Correct Answer:

Sources of Short-Term Funding for XYZ Airline

Introduction

XYZ, an airline with severe financial losses due to a two-year pandemic, requires short-term funding to maintain operations. With cash reserves at an all-time low, the airline needs immediate working capital to cover employee salaries, aircraft maintenance, airport fees, and fuel costs.

Short-term funding options provide temporary liquidity but come with different risks and costs. This answer evaluates four sources of short-term funding and recommends the best option for XYZ.

1. Bank Overdraft (Flexible Borrowing Facility)

Explanation:

A bank overdraft allows XYZ to withdraw funds beyond its available balance, up to a set limit.

✅ Advantages

✔ Flexible borrowing - Funds can be accessed as needed.

✔ Quick to arrange - Available through existing bank relationships.

✔ Interest only on borrowed amount - No need to take a large loan upfront.

❌ Disadvantages

✖ High-interest rates - Overdrafts often have higher interest than standard loans.

✖ Limited borrowing capacity - May not be enough to cover all costs.

✖ Bank may demand repayment at short notice.

Best for: Covering minor cash flow shortages but not large-scale operational funding.

2. Short-Term Business Loan (Fixed-Term Borrowing from a Bank or Lender) Explanation:

A short-term loan provides a lump sum of cash that XYZ must repay over a set period (typically 3-12 months).

✅ Advantages

✔ Larger funding amounts available - More substantial than overdrafts.

✔ Predictable repayment terms - Fixed monthly payments help with planning.

✔ Can be secured or unsecured - Secured loans offer lower interest rates.

❌ Disadvantages

✖ Requires repayment even if revenue is still low.

✖ Potentially high interest rates, especially for unsecured loans.

✖ Approval process may take time.

Best for: Covering larger operational costs like aircraft maintenance and staff salaries.

3. Sale and Leaseback of Assets (Liquidity from Selling Existing Assets) Explanation:

XYZ can sell its aircraft or other assets to an investor or leasing company and then lease them back for continued use.

✅ Advantages

✔ Immediate cash injection without losing operational assets.

✔ No repayment burden - Unlike loans, it does not increase debt levels.

✔ Improves cash flow for essential expenses.

❌ Disadvantages

✖ Long-term cost increase - Leasing is more expensive than owning in the long run.

✖ Loss of asset ownership - Limits financial flexibility in the future.

✖ Dependent on market conditions - Aircraft resale values fluctuate.

Best for: Raising large capital quickly while continuing operations.

4. Government Grants or Emergency Aid (Public Sector Financial Assistance) Explanation:

Governments often provide financial aid or grants to struggling industries, especially airlines affected by global crises.

✅ Advantages

✔ No repayment required - Unlike loans, grants do not need to be repaid.

✔ Low risk - Does not increase financial liabilities.

✔ Supports industry stability - Governments want airlines to survive for economic reasons.

❌ Disadvantages

✖ Lengthy approval process - Bureaucratic delays may not provide immediate relief.

✖ Strict eligibility requirements - XYZ must meet conditions set by the government.

✖ Potential public criticism - Bailouts may attract negative media attention.

Best for: Long-term financial recovery rather than immediate short-term cash flow issues.

5. Recommendation: Best Source for XYZ

Recommended Option:Sale and Leaseback of Assets

Why?

✅ Provides immediate liquidity - Essential for covering urgent operational costs.

✅ No additional debt burden - Unlike loans, it does not create financial liabilities.

✅ Ensures business continuity - XYZ can still operate leased aircraft.

Secondary Option: Short-Term Loan

If sale and leaseback is not viable, a short-term business loan can be used for emergency liquidity, but it increases financial risk.

Final Takeaway:

Sale and Leaseback → Best for quick large-scale funding without debt.

Short-Term Loan → A backup option if leasing is unavailable.

Introduction

XYZ, an airline with severe financial losses due to a two-year pandemic, requires short-term funding to maintain operations. With cash reserves at an all-time low, the airline needs immediate working capital to cover employee salaries, aircraft maintenance, airport fees, and fuel costs.

Short-term funding options provide temporary liquidity but come with different risks and costs. This answer evaluates four sources of short-term funding and recommends the best option for XYZ.

1. Bank Overdraft (Flexible Borrowing Facility)

Explanation:

A bank overdraft allows XYZ to withdraw funds beyond its available balance, up to a set limit.

✅ Advantages

✔ Flexible borrowing - Funds can be accessed as needed.

✔ Quick to arrange - Available through existing bank relationships.

✔ Interest only on borrowed amount - No need to take a large loan upfront.

❌ Disadvantages

✖ High-interest rates - Overdrafts often have higher interest than standard loans.

✖ Limited borrowing capacity - May not be enough to cover all costs.

✖ Bank may demand repayment at short notice.

Best for: Covering minor cash flow shortages but not large-scale operational funding.

2. Short-Term Business Loan (Fixed-Term Borrowing from a Bank or Lender) Explanation:

A short-term loan provides a lump sum of cash that XYZ must repay over a set period (typically 3-12 months).

✅ Advantages

✔ Larger funding amounts available - More substantial than overdrafts.

✔ Predictable repayment terms - Fixed monthly payments help with planning.

✔ Can be secured or unsecured - Secured loans offer lower interest rates.

❌ Disadvantages

✖ Requires repayment even if revenue is still low.

✖ Potentially high interest rates, especially for unsecured loans.

✖ Approval process may take time.

Best for: Covering larger operational costs like aircraft maintenance and staff salaries.

3. Sale and Leaseback of Assets (Liquidity from Selling Existing Assets) Explanation:

XYZ can sell its aircraft or other assets to an investor or leasing company and then lease them back for continued use.

✅ Advantages

✔ Immediate cash injection without losing operational assets.

✔ No repayment burden - Unlike loans, it does not increase debt levels.

✔ Improves cash flow for essential expenses.

❌ Disadvantages

✖ Long-term cost increase - Leasing is more expensive than owning in the long run.

✖ Loss of asset ownership - Limits financial flexibility in the future.

✖ Dependent on market conditions - Aircraft resale values fluctuate.

Best for: Raising large capital quickly while continuing operations.

4. Government Grants or Emergency Aid (Public Sector Financial Assistance) Explanation:

Governments often provide financial aid or grants to struggling industries, especially airlines affected by global crises.

✅ Advantages

✔ No repayment required - Unlike loans, grants do not need to be repaid.

✔ Low risk - Does not increase financial liabilities.

✔ Supports industry stability - Governments want airlines to survive for economic reasons.

❌ Disadvantages

✖ Lengthy approval process - Bureaucratic delays may not provide immediate relief.

✖ Strict eligibility requirements - XYZ must meet conditions set by the government.

✖ Potential public criticism - Bailouts may attract negative media attention.

Best for: Long-term financial recovery rather than immediate short-term cash flow issues.

5. Recommendation: Best Source for XYZ

Recommended Option:Sale and Leaseback of Assets

Why?

✅ Provides immediate liquidity - Essential for covering urgent operational costs.

✅ No additional debt burden - Unlike loans, it does not create financial liabilities.

✅ Ensures business continuity - XYZ can still operate leased aircraft.

Secondary Option: Short-Term Loan

If sale and leaseback is not viable, a short-term business loan can be used for emergency liquidity, but it increases financial risk.

Final Takeaway:

Sale and Leaseback → Best for quick large-scale funding without debt.

Short-Term Loan → A backup option if leasing is unavailable.

L6M2 Exam Question 2

SIMULATION

Discuss the following strategic decisions, explaining the advantages and constraints of each: Market Penetration, Product Development and Market Development.

Discuss the following strategic decisions, explaining the advantages and constraints of each: Market Penetration, Product Development and Market Development.

Correct Answer:

Evaluation of Strategic Decisions: Market Penetration, Product Development, and Market Development Introduction Strategic decisions in business involve selecting the best approach to grow market share, increase revenue, and sustain competitive advantage. According to Ansoff's Growth Matrix, businesses can pursue four strategic directions:

Market Penetration (expanding sales in existing markets with existing products) Product Development (introducing new products to existing markets) Market Development (expanding into new markets with existing products) Diversification (introducing new products to new markets) This answer focuses on Market Penetration, Product Development, and Market Development, discussing their advantages and constraints.

1. Market Penetration (Increasing sales of existing products in existing markets) Explanation:

Market penetration involves increasing market share by:

✅ Encouraging existing customers to buy more.

✅ Attracting competitors' customers.

✅ Increasing promotional efforts.

✅ Improving pricing strategies.

Example: Coca-Cola uses aggressive marketing, promotions, and pricing strategies to increase sales in existing markets.

Advantages of Market Penetration

✔ Low Risk - No need for new product development.

✔ Cost-Effective - Uses existing infrastructure and supply chain.

✔ Builds Market Leadership - Strengthens brand loyalty and customer retention.

✔ Quick Revenue Growth - Increased sales generate higher profits.

Constraints of Market Penetration

❌ Market Saturation - Limited growth potential if the market is already saturated.

❌ Intense Competition - Competitors may retaliate with price cuts and promotions.

❌ Diminishing Returns - Lowering prices to attract customers can reduce profitability.

Strategic Consideration: Businesses should assess customer demand and competitive intensity before implementing a market penetration strategy.

2. Product Development (Introducing new products to existing markets)

Explanation:

Product development involves launching new or improved products to meet evolving customer needs. This can include:

✅ Innovation - Developing new features or technology.

✅ Product Line Extensions - Introducing variations (e.g., new flavors, models, packaging).

✅ Customization - Tailoring products to specific customer preferences.

Example: Apple frequently launches new iPhone models to attract existing customers.

Advantages of Product Development

✔ Higher Customer Retention - Keeps existing customers engaged with new offerings.

✔ Brand Differentiation - Strengthens competitive advantage through innovation.

✔ Increases Revenue Streams - Expands product portfolio and market opportunities.

Constraints of Product Development

❌ High R&D Costs - Requires investment in innovation and testing.

❌ Market Uncertainty - New products may fail if not aligned with customer needs.

❌ Risk of Cannibalization - New products may reduce sales of existing products.

Strategic Consideration: Businesses should conduct market research, prototyping, and feasibility analysis before launching new products.

3. Market Development (Expanding into new markets with existing products) Explanation:

Market development involves selling existing products in new geographical areas or customer segments. Strategies include:

✅ Expanding into international markets.

✅ Targeting new demographics (e.g., different age groups or industries).

✅ Entering new distribution channels (e.g., e-commerce, retail stores).

Example: McDonald's expands into new countries, adapting its menu to local preferences.

Advantages of Market Development

✔ Access to New Revenue Streams - Increases customer base and sales.

✔ Diversifies Market Risk - Reduces dependency on a single region.

✔ Leverages Existing Products - No need for costly product innovation.

Constraints of Market Development

❌ Cultural and Regulatory Barriers - Differences in consumer behavior, legal requirements, and competition.

❌ High Entry Costs - Requires investment in marketing, distribution, and local partnerships.

❌ Operational Challenges - Managing supply chains and logistics in new markets.

Strategic Consideration: Businesses should conduct market analysis and risk assessments before expanding internationally.

Conclusion

Each strategic decision has unique benefits and challenges:

✅ Market Penetration is low-risk but limited by market saturation.

✅ Product Development drives innovation but requires high investment.

✅ Market Development expands revenue streams but involves cultural and regulatory challenges.

The best approach depends on a company's competitive position, financial resources, and long-term growth objectives.

Market Penetration (expanding sales in existing markets with existing products) Product Development (introducing new products to existing markets) Market Development (expanding into new markets with existing products) Diversification (introducing new products to new markets) This answer focuses on Market Penetration, Product Development, and Market Development, discussing their advantages and constraints.

1. Market Penetration (Increasing sales of existing products in existing markets) Explanation:

Market penetration involves increasing market share by:

✅ Encouraging existing customers to buy more.

✅ Attracting competitors' customers.

✅ Increasing promotional efforts.

✅ Improving pricing strategies.

Example: Coca-Cola uses aggressive marketing, promotions, and pricing strategies to increase sales in existing markets.

Advantages of Market Penetration

✔ Low Risk - No need for new product development.

✔ Cost-Effective - Uses existing infrastructure and supply chain.

✔ Builds Market Leadership - Strengthens brand loyalty and customer retention.

✔ Quick Revenue Growth - Increased sales generate higher profits.

Constraints of Market Penetration

❌ Market Saturation - Limited growth potential if the market is already saturated.

❌ Intense Competition - Competitors may retaliate with price cuts and promotions.

❌ Diminishing Returns - Lowering prices to attract customers can reduce profitability.

Strategic Consideration: Businesses should assess customer demand and competitive intensity before implementing a market penetration strategy.

2. Product Development (Introducing new products to existing markets)

Explanation:

Product development involves launching new or improved products to meet evolving customer needs. This can include:

✅ Innovation - Developing new features or technology.

✅ Product Line Extensions - Introducing variations (e.g., new flavors, models, packaging).

✅ Customization - Tailoring products to specific customer preferences.

Example: Apple frequently launches new iPhone models to attract existing customers.

Advantages of Product Development

✔ Higher Customer Retention - Keeps existing customers engaged with new offerings.

✔ Brand Differentiation - Strengthens competitive advantage through innovation.

✔ Increases Revenue Streams - Expands product portfolio and market opportunities.

Constraints of Product Development

❌ High R&D Costs - Requires investment in innovation and testing.

❌ Market Uncertainty - New products may fail if not aligned with customer needs.

❌ Risk of Cannibalization - New products may reduce sales of existing products.

Strategic Consideration: Businesses should conduct market research, prototyping, and feasibility analysis before launching new products.

3. Market Development (Expanding into new markets with existing products) Explanation:

Market development involves selling existing products in new geographical areas or customer segments. Strategies include:

✅ Expanding into international markets.

✅ Targeting new demographics (e.g., different age groups or industries).

✅ Entering new distribution channels (e.g., e-commerce, retail stores).

Example: McDonald's expands into new countries, adapting its menu to local preferences.

Advantages of Market Development

✔ Access to New Revenue Streams - Increases customer base and sales.

✔ Diversifies Market Risk - Reduces dependency on a single region.

✔ Leverages Existing Products - No need for costly product innovation.

Constraints of Market Development

❌ Cultural and Regulatory Barriers - Differences in consumer behavior, legal requirements, and competition.

❌ High Entry Costs - Requires investment in marketing, distribution, and local partnerships.

❌ Operational Challenges - Managing supply chains and logistics in new markets.

Strategic Consideration: Businesses should conduct market analysis and risk assessments before expanding internationally.

Conclusion

Each strategic decision has unique benefits and challenges:

✅ Market Penetration is low-risk but limited by market saturation.

✅ Product Development drives innovation but requires high investment.

✅ Market Development expands revenue streams but involves cultural and regulatory challenges.

The best approach depends on a company's competitive position, financial resources, and long-term growth objectives.

L6M2 Exam Question 3

SIMULATION

XYZ is a manufacturing company based in the UK. It has a large complex supply chain and imports raw materials from Argentina and South Africa. It sells completed products internationally via their website. Evaluate the role of licencing and taxation on XYZ's operations.

XYZ is a manufacturing company based in the UK. It has a large complex supply chain and imports raw materials from Argentina and South Africa. It sells completed products internationally via their website. Evaluate the role of licencing and taxation on XYZ's operations.

Correct Answer:

Evaluation of the Role of Licensing and Taxation on XYZ's Operations

Introduction

Licensing and taxation play a critical role in international trade, supply chain management, and overall financial performance. For XYZ, a UK-based manufacturing company that imports raw materials from Argentina and South Africa and sells internationally via an e-commerce platform, compliance with licensing and taxation regulations is essential to ensure smooth operations, cost efficiency, and legal compliance.

This evaluation will assess the impact of licensing and taxation on XYZ's global supply chain, import/export activities, and financial performance.

1. The Role of Licensing in XYZ's Operations

1.1 Import and Export Licensing Regulations

As XYZ imports raw materials from Argentina and South Africa, it must comply with the UK's import licensing requirements and trade agreements with these countries.

✅ Impact on XYZ:

Import licenses may be required for certain restricted raw materials (e.g., metals, chemicals, agricultural products).

Export control laws may apply, depending on the destination of final products.

Delays or fines may occur if licenses are not properly managed.

Example: If XYZ imports metal components subject to UK trade restrictions, it must secure import licenses before shipment clearance.

1.2 Industry-Specific Licensing Requirements

Some industries require special licenses to manufacture and sell products globally.

✅ Impact on XYZ:

If XYZ manufactures electronics or chemical-based products, it may need compliance certifications (e.g., CE marking in the EU, FDA approval in the US).

Failure to meet licensing requirements can block international sales.

Example: A UK manufacturer selling medical devices must obtain MHRA (Medicines and Healthcare products Regulatory Agency) approval before distributing products.

1.3 E-Commerce & Digital Sales Licensing

As XYZ sells its products internationally via its website, it must comply with:

✅ Consumer Protection Laws (e.g., GDPR for EU customers).

✅ E-commerce business registration and online sales regulations.

Example: XYZ may need a VAT number in the EU if it sells products to European customers via its website.

2. The Role of Taxation in XYZ's Operations

2.1 Import Duties and Tariffs

XYZ's supply chain involves importing raw materials from Argentina and South Africa, which may attract import duties and tariffs.

✅ Impact on XYZ:

Higher import duties increase raw material costs and impact profitability.

Tariff-free trade agreements (e.g., UK-South Africa trade deal) may reduce costs.

Post-Brexit UK-EU trade regulations may affect supply chain tax structures.

Example: If the UK imposes high tariffs on South African goods, XYZ may need to find alternative suppliers or negotiate better deals.

2.2 Corporate Tax & International Tax Compliance

XYZ must comply with UK corporate tax laws and international taxation regulations.

✅ Impact on XYZ:

Paying corporate tax in the UK based on global sales revenue.

Managing international tax obligations when selling in multiple countries.

Risk of double taxation if the same income is taxed in multiple jurisdictions.

Example: If XYZ sells products in Germany and the US, it may need to register for tax in those countries and comply with local VAT/GST requirements.

2.3 Value Added Tax (VAT) & Sales Tax

Since XYZ sells internationally via its website, it must adhere to global VAT and sales tax rules.

✅ Impact on XYZ:

In the EU, VAT registration is required for online sales above a certain threshold.

In the US, sales tax regulations vary by state.

Compliance with UK VAT laws (e.g., 20% standard rate) on domestic sales.

Example: A UK company selling online to EU customers must comply with the EU One-Stop-Shop (OSS) VAT scheme.

2.4 Transfer Pricing & Tax Efficiency

If XYZ has international subsidiaries or supply chain partners, it must manage transfer pricing regulations.

✅ Impact on XYZ:

Ensuring fair pricing between UK operations and overseas suppliers to avoid tax penalties.

Optimizing tax-efficient supply chain structures to minimize tax burdens.

Example: Multinational companies like Apple and Amazon use tax-efficient structures to reduce liabilities.

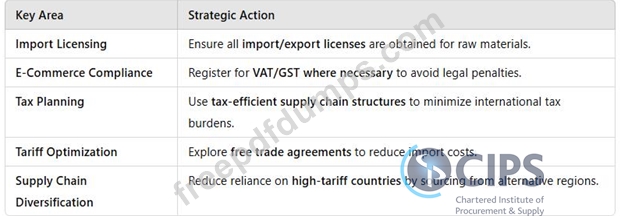

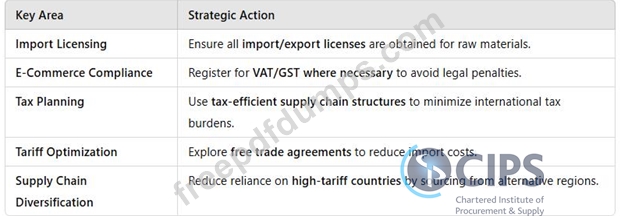

3. Strategic Actions for XYZ to Manage Licensing and Taxation Effectively XYZ can take several steps to optimize tax compliance and licensing efficiency:

Conclusion

Licensing and taxation have a major impact on XYZ's international manufacturing and e-commerce operations. To maintain profitability and regulatory compliance, XYZ must:

✅ Ensure import/export licensing aligns with UK and international trade laws.

✅ Manage import duties, VAT, and corporate tax obligations effectively.

✅ Optimize its supply chain and tax planning to reduce costs.

By proactively managing these areas, XYZ can enhance its global competitiveness while minimizing risks.

Introduction

Licensing and taxation play a critical role in international trade, supply chain management, and overall financial performance. For XYZ, a UK-based manufacturing company that imports raw materials from Argentina and South Africa and sells internationally via an e-commerce platform, compliance with licensing and taxation regulations is essential to ensure smooth operations, cost efficiency, and legal compliance.

This evaluation will assess the impact of licensing and taxation on XYZ's global supply chain, import/export activities, and financial performance.

1. The Role of Licensing in XYZ's Operations

1.1 Import and Export Licensing Regulations

As XYZ imports raw materials from Argentina and South Africa, it must comply with the UK's import licensing requirements and trade agreements with these countries.

✅ Impact on XYZ:

Import licenses may be required for certain restricted raw materials (e.g., metals, chemicals, agricultural products).

Export control laws may apply, depending on the destination of final products.

Delays or fines may occur if licenses are not properly managed.

Example: If XYZ imports metal components subject to UK trade restrictions, it must secure import licenses before shipment clearance.

1.2 Industry-Specific Licensing Requirements

Some industries require special licenses to manufacture and sell products globally.

✅ Impact on XYZ:

If XYZ manufactures electronics or chemical-based products, it may need compliance certifications (e.g., CE marking in the EU, FDA approval in the US).

Failure to meet licensing requirements can block international sales.

Example: A UK manufacturer selling medical devices must obtain MHRA (Medicines and Healthcare products Regulatory Agency) approval before distributing products.

1.3 E-Commerce & Digital Sales Licensing

As XYZ sells its products internationally via its website, it must comply with:

✅ Consumer Protection Laws (e.g., GDPR for EU customers).

✅ E-commerce business registration and online sales regulations.

Example: XYZ may need a VAT number in the EU if it sells products to European customers via its website.

2. The Role of Taxation in XYZ's Operations

2.1 Import Duties and Tariffs

XYZ's supply chain involves importing raw materials from Argentina and South Africa, which may attract import duties and tariffs.

✅ Impact on XYZ:

Higher import duties increase raw material costs and impact profitability.

Tariff-free trade agreements (e.g., UK-South Africa trade deal) may reduce costs.

Post-Brexit UK-EU trade regulations may affect supply chain tax structures.

Example: If the UK imposes high tariffs on South African goods, XYZ may need to find alternative suppliers or negotiate better deals.

2.2 Corporate Tax & International Tax Compliance

XYZ must comply with UK corporate tax laws and international taxation regulations.

✅ Impact on XYZ:

Paying corporate tax in the UK based on global sales revenue.

Managing international tax obligations when selling in multiple countries.

Risk of double taxation if the same income is taxed in multiple jurisdictions.

Example: If XYZ sells products in Germany and the US, it may need to register for tax in those countries and comply with local VAT/GST requirements.

2.3 Value Added Tax (VAT) & Sales Tax

Since XYZ sells internationally via its website, it must adhere to global VAT and sales tax rules.

✅ Impact on XYZ:

In the EU, VAT registration is required for online sales above a certain threshold.

In the US, sales tax regulations vary by state.

Compliance with UK VAT laws (e.g., 20% standard rate) on domestic sales.

Example: A UK company selling online to EU customers must comply with the EU One-Stop-Shop (OSS) VAT scheme.

2.4 Transfer Pricing & Tax Efficiency

If XYZ has international subsidiaries or supply chain partners, it must manage transfer pricing regulations.

✅ Impact on XYZ:

Ensuring fair pricing between UK operations and overseas suppliers to avoid tax penalties.

Optimizing tax-efficient supply chain structures to minimize tax burdens.

Example: Multinational companies like Apple and Amazon use tax-efficient structures to reduce liabilities.

3. Strategic Actions for XYZ to Manage Licensing and Taxation Effectively XYZ can take several steps to optimize tax compliance and licensing efficiency:

Conclusion

Licensing and taxation have a major impact on XYZ's international manufacturing and e-commerce operations. To maintain profitability and regulatory compliance, XYZ must:

✅ Ensure import/export licensing aligns with UK and international trade laws.

✅ Manage import duties, VAT, and corporate tax obligations effectively.

✅ Optimize its supply chain and tax planning to reduce costs.

By proactively managing these areas, XYZ can enhance its global competitiveness while minimizing risks.

L6M2 Exam Question 4

SIMULATION

XYZ is a large manufacturing organisation which employs 200 skilled staff in its factory in Bolton. It has a large global supply chain with raw materials sourced from Asia and Africa. Discuss five areas of policy that can affect the people working in the supply chain

XYZ is a large manufacturing organisation which employs 200 skilled staff in its factory in Bolton. It has a large global supply chain with raw materials sourced from Asia and Africa. Discuss five areas of policy that can affect the people working in the supply chain

Correct Answer:

Five Areas of Policy Affecting People in the Supply Chain - XYZ Manufacturing Introduction A global supply chain involves multiple stakeholders, including suppliers, logistics providers, and factory workers. Policies at corporate, national, and international levels impact the working conditions, rights, and well-being of people within the supply chain.

For XYZ, a large manufacturing company with a factory in Bolton and suppliers in Asia and Africa, key policy areas affecting its workforce and supply chain workers include labor rights, health and safety, wages, environmental regulations, and ethical sourcing.

1. Labor Laws and Workers' Rights Policies

Policies related to employment laws, working hours, and fair treatment impact supply chain workers' rights.

✅ Key Areas of Impact

Child labor and forced labor laws ensure ethical sourcing.

Working hours and overtime regulations prevent worker exploitation.

Freedom of association (e.g., the right to join trade unions) allows collective bargaining.

Example: The International Labour Organization (ILO) conventions set global labor standards, influencing suppliers in Asia and Africa.

✅ Impact on XYZ

Must audit suppliers to ensure compliance with fair labor policies.

Risk of reputational damage if suppliers engage in unethical labor practices.

2. Health and Safety Regulations

Policies ensuring safe working conditions in manufacturing and supply chain operations protect employees from hazards.

✅ Key Areas of Impact

Workplace safety (e.g., protective equipment, fire prevention, accident reporting).

Factory compliance with OSHA (Occupational Safety and Health Administration) standards.

COVID-19 and pandemic-related health protocols in global supply chains.

Example: Bangladesh's Rana Plaza factory collapse (2013) highlighted the dangers of weak safety regulations, prompting global reforms in factory safety policies.

✅ Impact on XYZ

Needs to conduct supplier audits to ensure compliance with safety laws.

May need to invest in better safety training for factory workers in Bolton.

3. Wages and Fair Pay Policies

Regulations and policies on minimum wages, equal pay, and fair compensation influence worker conditions in global supply chains.

✅ Key Areas of Impact

Minimum wage laws in supplier countries affect labor costs.

Fair pay policies ensure workers are not underpaid or exploited.

Gender pay equity promotes inclusive employment practices.

Example: The UK's National Minimum Wage ensures fair pay, but wages in Asia and Africa may be significantly lower.

✅ Impact on XYZ

Needs to ensure suppliers pay living wages to avoid reputational risks.

Could face supply chain disruptions if wage disputes lead to strikes or protests.

4. Environmental and Sustainability Policies

Environmental policies regulate how businesses source raw materials, manage waste, and reduce carbon emissions.

✅ Key Areas of Impact

Deforestation and raw material sourcing laws (e.g., FSC-certified timber, conflict minerals regulations).

Carbon emissions policies affect logistics and transportation.

Waste disposal and pollution regulations impact factory operations.

Example: The EU's Carbon Border Adjustment Mechanism (CBAM) affects importers sourcing from high-carbon-emitting regions.

✅ Impact on XYZ

Must ensure suppliers meet environmental standards to avoid legal penalties.

Needs to reduce carbon footprint by choosing sustainable transport and materials.

5. Ethical Sourcing and Corporate Social Responsibility (CSR) Policies

Ethical sourcing policies ensure companies buy from responsible suppliers that uphold human rights and environmental protection.

✅ Key Areas of Impact

Modern Slavery Act (UK, 2015) requires firms to report on anti-slavery efforts.

Fairtrade and ethical certification policies ensure responsible supply chain practices.

CSR commitments require businesses to engage in community welfare programs.

Example: Nestlé has an Ethical Sourcing Program for cocoa, ensuring child labor-free supply chains.

✅ Impact on XYZ

Needs to conduct supplier due diligence to comply with ethical sourcing laws.

Ethical policies can enhance brand reputation and customer trust.

Conclusion

Policies on labor rights, health and safety, fair wages, environmental sustainability, and ethical sourcing directly impact people working in XYZ's supply chain. To ensure compliance, XYZ must adopt robust supplier audits, transparent reporting, and ethical business practices to protect workers' rights while maintaining a resilient and responsible supply chain.

For XYZ, a large manufacturing company with a factory in Bolton and suppliers in Asia and Africa, key policy areas affecting its workforce and supply chain workers include labor rights, health and safety, wages, environmental regulations, and ethical sourcing.

1. Labor Laws and Workers' Rights Policies

Policies related to employment laws, working hours, and fair treatment impact supply chain workers' rights.

✅ Key Areas of Impact

Child labor and forced labor laws ensure ethical sourcing.

Working hours and overtime regulations prevent worker exploitation.

Freedom of association (e.g., the right to join trade unions) allows collective bargaining.

Example: The International Labour Organization (ILO) conventions set global labor standards, influencing suppliers in Asia and Africa.

✅ Impact on XYZ

Must audit suppliers to ensure compliance with fair labor policies.

Risk of reputational damage if suppliers engage in unethical labor practices.

2. Health and Safety Regulations

Policies ensuring safe working conditions in manufacturing and supply chain operations protect employees from hazards.

✅ Key Areas of Impact

Workplace safety (e.g., protective equipment, fire prevention, accident reporting).

Factory compliance with OSHA (Occupational Safety and Health Administration) standards.

COVID-19 and pandemic-related health protocols in global supply chains.

Example: Bangladesh's Rana Plaza factory collapse (2013) highlighted the dangers of weak safety regulations, prompting global reforms in factory safety policies.

✅ Impact on XYZ

Needs to conduct supplier audits to ensure compliance with safety laws.

May need to invest in better safety training for factory workers in Bolton.

3. Wages and Fair Pay Policies

Regulations and policies on minimum wages, equal pay, and fair compensation influence worker conditions in global supply chains.

✅ Key Areas of Impact

Minimum wage laws in supplier countries affect labor costs.

Fair pay policies ensure workers are not underpaid or exploited.

Gender pay equity promotes inclusive employment practices.

Example: The UK's National Minimum Wage ensures fair pay, but wages in Asia and Africa may be significantly lower.

✅ Impact on XYZ

Needs to ensure suppliers pay living wages to avoid reputational risks.

Could face supply chain disruptions if wage disputes lead to strikes or protests.

4. Environmental and Sustainability Policies

Environmental policies regulate how businesses source raw materials, manage waste, and reduce carbon emissions.

✅ Key Areas of Impact

Deforestation and raw material sourcing laws (e.g., FSC-certified timber, conflict minerals regulations).

Carbon emissions policies affect logistics and transportation.

Waste disposal and pollution regulations impact factory operations.

Example: The EU's Carbon Border Adjustment Mechanism (CBAM) affects importers sourcing from high-carbon-emitting regions.

✅ Impact on XYZ

Must ensure suppliers meet environmental standards to avoid legal penalties.

Needs to reduce carbon footprint by choosing sustainable transport and materials.

5. Ethical Sourcing and Corporate Social Responsibility (CSR) Policies

Ethical sourcing policies ensure companies buy from responsible suppliers that uphold human rights and environmental protection.

✅ Key Areas of Impact

Modern Slavery Act (UK, 2015) requires firms to report on anti-slavery efforts.

Fairtrade and ethical certification policies ensure responsible supply chain practices.

CSR commitments require businesses to engage in community welfare programs.

Example: Nestlé has an Ethical Sourcing Program for cocoa, ensuring child labor-free supply chains.

✅ Impact on XYZ

Needs to conduct supplier due diligence to comply with ethical sourcing laws.

Ethical policies can enhance brand reputation and customer trust.

Conclusion

Policies on labor rights, health and safety, fair wages, environmental sustainability, and ethical sourcing directly impact people working in XYZ's supply chain. To ensure compliance, XYZ must adopt robust supplier audits, transparent reporting, and ethical business practices to protect workers' rights while maintaining a resilient and responsible supply chain.

L6M2 Exam Question 5

SIMULATION

Evaluate diversification as a growth strategy. What are the main drivers and risks?

Evaluate diversification as a growth strategy. What are the main drivers and risks?

Correct Answer:

Evaluation of Diversification as a Growth Strategy

Introduction

Diversification is a growth strategy where a company expands into new markets or develops new products that are different from its existing offerings. It is the riskiest strategy in Ansoff's Growth Matrix, but it can provide significant opportunities for business expansion, revenue diversification, and risk mitigation.

Diversification is driven by factors such as market saturation, competitive pressure, and technological advancements but also carries risks related to high investment costs and operational complexity.

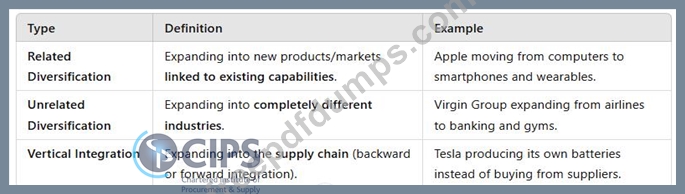

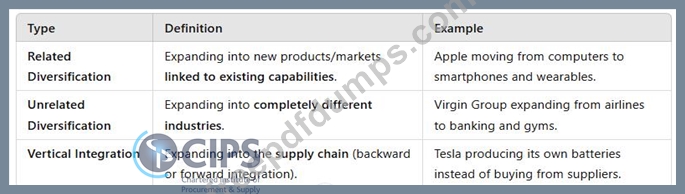

1. Types of Diversification

2. Main Drivers of Diversification

1. Market Saturation and Competitive Pressure

When a business reaches peak growth in its existing market, diversification helps find new revenue streams.

Competition forces businesses to explore new industries for continued growth.

Example: Amazon expanded from an online bookstore to cloud computing (AWS) due to competition and limited retail growth.

2. Risk Reduction and Business Sustainability

Diversifying reduces dependence on a single market or product.

Protects the business against economic downturns and industry-specific risks.

Example: Samsung operates in electronics, shipbuilding, and insurance, reducing reliance on one sector.

3. Leveraging Core Competencies and Brand Strength

Companies use existing expertise, technology, or brand reputation to enter new markets.

Example: Nike expanded from sportswear to fitness apps and wearable technology.

4. Technological Advancements & Market Opportunities

Digital transformation and innovation create opportunities for diversification.

Companies invest in new technologies, AI, and automation to expand their offerings.

Example: Google diversified into AI, smart home devices, and autonomous vehicles (Waymo).

3. Risks of Diversification

1. High Investment Costs & Uncertain Returns

Diversification requires significant R&D, marketing, and infrastructure investment.

ROI is uncertain, and failure can result in financial losses.

Example: Coca-Cola's failed diversification into the wine industry resulted in losses due to brand mismatch.

2. Lack of Expertise & Operational Challenges

Expanding into unfamiliar industries increases operational complexity and risks.

Companies may lack the expertise required for success.

Example: Tesco's expansion into the US market (Fresh & Easy) failed due to a lack of understanding of American consumer behavior.

3. Dilution of Brand Identity

Expanding into unrelated sectors can confuse customers and weaken brand strength.

Example: Harley-Davidson's attempt to enter the perfume market damaged its brand credibility.

4. Regulatory and Legal Barriers

Compliance with different industry regulations can be complex and costly.

Example: Facebook faced regulatory scrutiny when diversifying into financial services with Libra cryptocurrency.

4. Conclusion

Diversification can be a high-reward growth strategy, but it requires careful planning, market research, and strategic alignment.

✅ Main drivers include market saturation, risk reduction, leveraging expertise, and technology opportunities.

❌ Key risks include high costs, operational challenges, brand dilution, and regulatory barriers.

Companies must evaluate diversification carefully and ensure strategic fit, financial feasibility, and market demand before expanding into new industries.

Introduction

Diversification is a growth strategy where a company expands into new markets or develops new products that are different from its existing offerings. It is the riskiest strategy in Ansoff's Growth Matrix, but it can provide significant opportunities for business expansion, revenue diversification, and risk mitigation.

Diversification is driven by factors such as market saturation, competitive pressure, and technological advancements but also carries risks related to high investment costs and operational complexity.

1. Types of Diversification

2. Main Drivers of Diversification

1. Market Saturation and Competitive Pressure

When a business reaches peak growth in its existing market, diversification helps find new revenue streams.

Competition forces businesses to explore new industries for continued growth.

Example: Amazon expanded from an online bookstore to cloud computing (AWS) due to competition and limited retail growth.

2. Risk Reduction and Business Sustainability

Diversifying reduces dependence on a single market or product.

Protects the business against economic downturns and industry-specific risks.

Example: Samsung operates in electronics, shipbuilding, and insurance, reducing reliance on one sector.

3. Leveraging Core Competencies and Brand Strength

Companies use existing expertise, technology, or brand reputation to enter new markets.

Example: Nike expanded from sportswear to fitness apps and wearable technology.

4. Technological Advancements & Market Opportunities

Digital transformation and innovation create opportunities for diversification.

Companies invest in new technologies, AI, and automation to expand their offerings.

Example: Google diversified into AI, smart home devices, and autonomous vehicles (Waymo).

3. Risks of Diversification

1. High Investment Costs & Uncertain Returns

Diversification requires significant R&D, marketing, and infrastructure investment.

ROI is uncertain, and failure can result in financial losses.

Example: Coca-Cola's failed diversification into the wine industry resulted in losses due to brand mismatch.

2. Lack of Expertise & Operational Challenges

Expanding into unfamiliar industries increases operational complexity and risks.

Companies may lack the expertise required for success.

Example: Tesco's expansion into the US market (Fresh & Easy) failed due to a lack of understanding of American consumer behavior.

3. Dilution of Brand Identity

Expanding into unrelated sectors can confuse customers and weaken brand strength.

Example: Harley-Davidson's attempt to enter the perfume market damaged its brand credibility.

4. Regulatory and Legal Barriers

Compliance with different industry regulations can be complex and costly.

Example: Facebook faced regulatory scrutiny when diversifying into financial services with Libra cryptocurrency.

4. Conclusion

Diversification can be a high-reward growth strategy, but it requires careful planning, market research, and strategic alignment.

✅ Main drivers include market saturation, risk reduction, leveraging expertise, and technology opportunities.

❌ Key risks include high costs, operational challenges, brand dilution, and regulatory barriers.

Companies must evaluate diversification carefully and ensure strategic fit, financial feasibility, and market demand before expanding into new industries.

- Latest Upload

- 107Salesforce.ADM-201.v2025-09-06.q260

- 104Oracle.1Z0-1055-23.v2025-09-06.q48

- 104Cisco.010-151.v2025-09-06.q130

- 130PMI.PMI-PBA.v2025-09-05.q160

- 139Salesforce.Advanced-Cross-Channel.v2025-09-04.q41

- 134EC-COUNCIL.312-40.v2025-09-04.q87

- 148Oracle.1Z1-591.v2025-09-03.q129

- 129Oracle.1z0-1065-25.v2025-09-03.q26

- 162Cisco.350-701.v2025-09-03.q218

- 126Oracle.1Z0-1195-25.v2025-09-03.q20