CORe Exam Question 1

The media discovers that an automobile manufacturer has been secretly polluting the rivers near its plants. After this discovery, the government imposes a punitive fee on the company, and a group of consumers begins to boycott the manufacturer. What will be the total effect of these simultaneous events?

CORe Exam Question 2

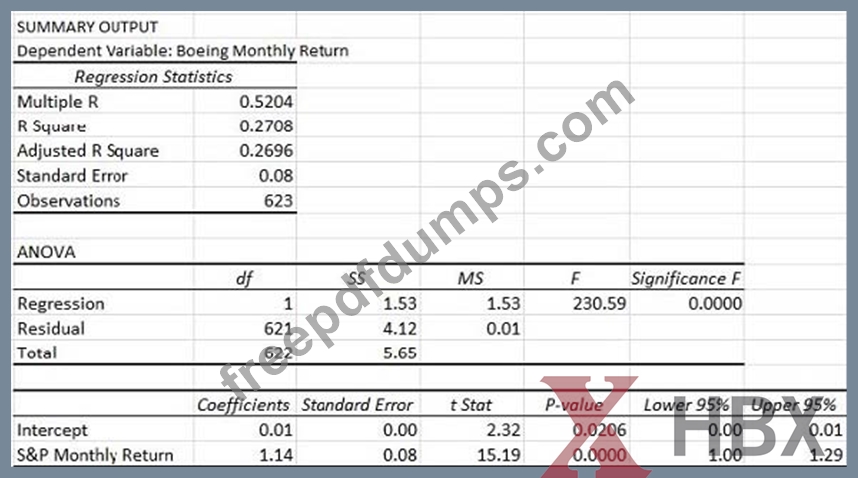

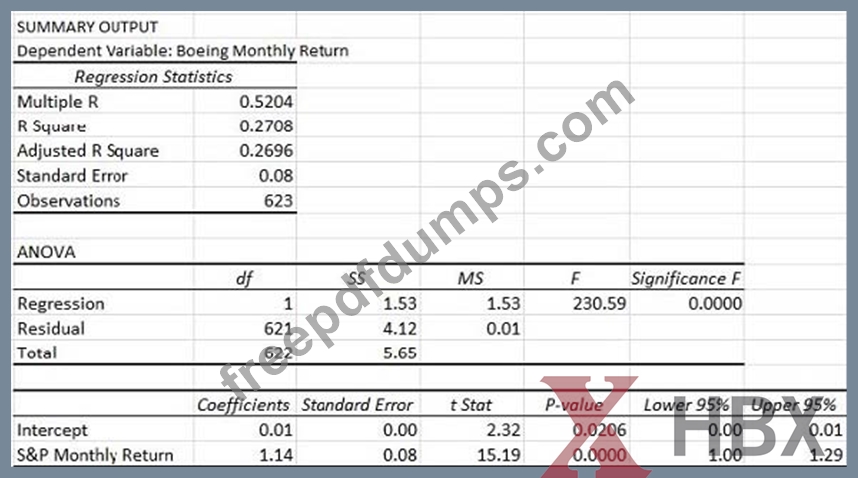

In finance, beta is a measure of the systematic risk of a security in comparison to the market as a whole. Beta can be found by running a regression analysis of the monthly returns of the security versus the monthly returns of the general market. The regression output table below shows the relationship between Boeing's monthly returns and the monthly returns of the Standard and Poor's 500 (S&P 500) which is a stock market index of 500 large companies.

If beta is the average change in Boeing's monthly returns as the monthly returns of the S&P 500 increase by one, what is Boeing's beta?

If beta is the average change in Boeing's monthly returns as the monthly returns of the S&P 500 increase by one, what is Boeing's beta?

CORe Exam Question 3

Company B sold a service contract that covers a two-year period for $10,000. The service period commenced on July 1, Year 1. Service revenue is recognized evenly throughout the contract period. What amount should Company B report as deferred revenue from this service contract on its balance sheet on December 31, Year 1?

CORe Exam Question 4

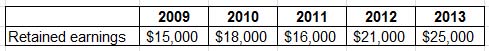

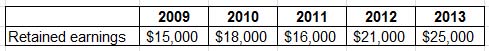

A company's retained earnings on Dec. 31st, 2009 to 2013 is as follows:

On the pro-forma income statement for 2014, the net income is $10,000. The expected dividends to be paid in 2014 is $3,500. What is the projected retained earnings on Dec. 31st, 2014?

On the pro-forma income statement for 2014, the net income is $10,000. The expected dividends to be paid in 2014 is $3,500. What is the projected retained earnings on Dec. 31st, 2014?

CORe Exam Question 5

A computer software company with market power is about to release two new products. The company knows that there is high variability in consumers' willingness to pay (WTP) for each individual product, but a customer with a low WTP for one good is likely to have a high WTPfor the other. If the marginal cost of software is $0, what pricing structure is MOST likely to maximize profits for the computer software firm?