1Z0-1060-21 Exam Question 1

Which two actions can you accomplish for a registered source system?

1Z0-1060-21 Exam Question 2

You have created a description rule. When you try to select this description rule to be displayed as a header description rule in a journal entry rule set, you are not able to find this rule in the list of values.

What is the possible reason for NOT finding the rule?

What is the possible reason for NOT finding the rule?

1Z0-1060-21 Exam Question 3

Which two can you use to view supporting reference balances?

1Z0-1060-21 Exam Question 4

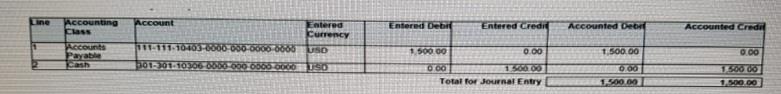

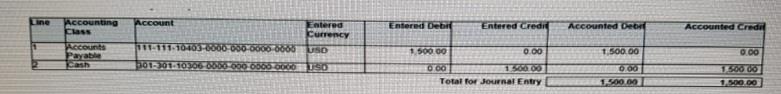

Given the subledger journal entry:

Note that the first segment is the primary balancing segment.

Which statement is True regarding this subledger journal entry?

Note that the first segment is the primary balancing segment.

Which statement is True regarding this subledger journal entry?

1Z0-1060-21 Exam Question 5

Given the business use case:

'New Trucks' runs a fleet of trucks in a rentalbusiness In the U.S. The majority of the trucks are owned; however, In some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the Internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company

'Fix Trucks' that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: totalmaintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income. 'New Trucks' and' Fix Trucks' are located in the same country and share chart-of accounts and accounting conventions.

How manyledgers are required to be set up?

'New Trucks' runs a fleet of trucks in a rentalbusiness In the U.S. The majority of the trucks are owned; however, In some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the Internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company

'Fix Trucks' that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: totalmaintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income. 'New Trucks' and' Fix Trucks' are located in the same country and share chart-of accounts and accounting conventions.

How manyledgers are required to be set up?