CAMS-CN Exam Question 56

金融行動特別工作小組第 29 條建議中所描述的金融情報機構 (FIU) 的核心職能是什麼?

Correct Answer: A

FIUs act as central hubs for financial crime intelligence, receiving and analyzingSuspicious Activity Reports (SARs)and other data to support law enforcement.

* Option A (Correct):FIUscollect, analyze, and disseminate financial intelligencerelated tomoney laundering and terrorist financing.

* Option B (Incorrect):FIUsdo not prosecute cases-they refer cases tolaw enforcement agenciesfor prosecution.

* Option C (Incorrect):FIUs analyze financial crime data butdo not develop surveillance technology.

* Option D (Incorrect):FIUs share intelligencewith law enforcement and regulatory bodies, not directly with private companies.

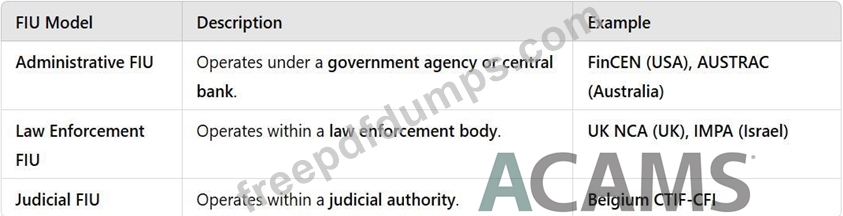

Types of FIUs and Their Roles:

A screenshot of a web page Description automatically generated

Key FIU Responsibilities:

* Collect Suspicious Activity Reports (SARs)from financial institutions.

* Analyze financial transactionsto identify money laundering patterns.

* Disseminate intelligence to law enforcement and regulatory authorities.

Reference:

FATF Recommendation 29 (FIUs and Financial Intelligence Sharing)

Egmont Group Guidelines on FIU Information Sharing

EU Directive on the Role of FIUs in AML/CFT

* Option A (Correct):FIUscollect, analyze, and disseminate financial intelligencerelated tomoney laundering and terrorist financing.

* Option B (Incorrect):FIUsdo not prosecute cases-they refer cases tolaw enforcement agenciesfor prosecution.

* Option C (Incorrect):FIUs analyze financial crime data butdo not develop surveillance technology.

* Option D (Incorrect):FIUs share intelligencewith law enforcement and regulatory bodies, not directly with private companies.

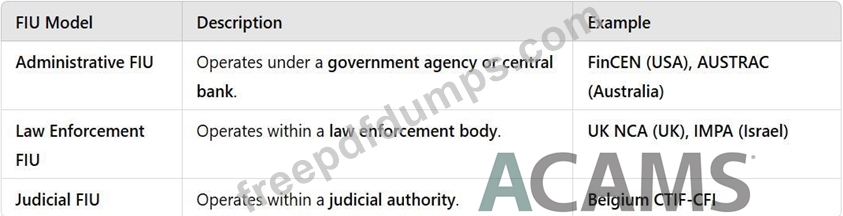

Types of FIUs and Their Roles:

A screenshot of a web page Description automatically generated

Key FIU Responsibilities:

* Collect Suspicious Activity Reports (SARs)from financial institutions.

* Analyze financial transactionsto identify money laundering patterns.

* Disseminate intelligence to law enforcement and regulatory authorities.

Reference:

FATF Recommendation 29 (FIUs and Financial Intelligence Sharing)

Egmont Group Guidelines on FIU Information Sharing

EU Directive on the Role of FIUs in AML/CFT

CAMS-CN Exam Question 57

金融機構收到有關客戶的大陪審團傳票時應採取哪些行動?

Correct Answer: D

A financial institution should consult with its legal counsel before responding to a grand jury subpoena regarding a customer, as such subpoenas may involve complex legal issues and potential conflicts of interest.

A grand jury subpoena is a legal order issued by a federal or state grand jury that compels a person or entity to produce documents, testify, or both, in connection with a criminal investigation. A financial institution that receives a grand jury subpoena should not disclose its existence or contents to the customer or any third party, unless authorized by law or the court, as doing so may constitute obstruction of justice or violate the secrecy rules of the grand jury. A financial institution should also assess and review all relevant information it has about the customer that is the subject of the subpoena, in accordance with its risk-based AML program, and consider filing a SAR if it identifies any suspicious activity.

References:

1: This article provides an overview of the legal and practical considerations for financial institutions when responding to subpoenas, including the types of subpoenas, the rules that apply, the confidentiality and privilege issues, and the procedural steps to follow.

2: This document provides answers to frequently asked questions regarding SARs and other AML considerations, including the question of how to handle grand jury subpoenas and other law enforcement inquiries.

A grand jury subpoena is a legal order issued by a federal or state grand jury that compels a person or entity to produce documents, testify, or both, in connection with a criminal investigation. A financial institution that receives a grand jury subpoena should not disclose its existence or contents to the customer or any third party, unless authorized by law or the court, as doing so may constitute obstruction of justice or violate the secrecy rules of the grand jury. A financial institution should also assess and review all relevant information it has about the customer that is the subject of the subpoena, in accordance with its risk-based AML program, and consider filing a SAR if it identifies any suspicious activity.

References:

1: This article provides an overview of the legal and practical considerations for financial institutions when responding to subpoenas, including the types of subpoenas, the rules that apply, the confidentiality and privilege issues, and the procedural steps to follow.

2: This document provides answers to frequently asked questions regarding SARs and other AML considerations, including the question of how to handle grand jury subpoenas and other law enforcement inquiries.

CAMS-CN Exam Question 58

巴塞爾銀行監理委員會所確定的 KYC 計畫的基本要素有哪些?

(選兩個。)

(選兩個。)

Correct Answer: B,D

According to the Basel Committee on Banking Supervision (BCBS), a sound KYC program should consist of four essential elements: (i) customer acceptance policy; (ii) customer identification; (iii) on-going monitoring of higher risk accounts; and (iv) risk management. Therefore, B and D are the correct choices among the given options. A customer acceptance policy defines the types of customers that the bank is willing to accept and the conditions for doing so. A risk management system ensures that the bank has adequate policies, procedures, and controls to identify, measure, monitor, and mitigate the risks arising from its KYC program.

References:

BCBS, Customer due diligence for banks, October 2001, p. 41

BCBS, Consolidated KYC Risk Management, October 2004, p. 42

References:

BCBS, Customer due diligence for banks, October 2001, p. 41

BCBS, Consolidated KYC Risk Management, October 2004, p. 42

CAMS-CN Exam Question 59

保險業洗錢活動中哪一事件最常發生?

Correct Answer: A

One of the most common methods of money laundering in the insurance industry is to purchase a policy with illicit funds and then request a refund of the premiums, either partially or fully, before the policy matures.

This way, the money launderer can receive a legitimate payment from the insurance company, effectively washing the dirty money. This technique is also known as premium fraud or early surrender12 According to the Financial Crimes Enforcement Network (FinCEN), the most significant money laundering and terrorist financing risks in the insurance industry are found in life insurance and annuity products, because such products allow a customer to place largeamounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin34 Some indicators of potential money laundering through insurance products are: 12

* The customer pays the premiums with cash, cashier's checks, money orders, or other anonymous or unusual payment methods.

* The customer overpays the premiums or makes multiple payments in excess of the required amount.

* The customer cancels the policy during the free-look or grace period and requests a refund to a different account or a third party.

* The customer purchases a policy that is inconsistent with their income, age, or risk profile.

* The customer shows little interest in the benefits or terms of the policy, but is more concerned about the cancellation or surrender options.

:

1: AML in Insurance: How to Detect & Combat Money Laundering, ComplyAdvantage, 2022

2: Anti Money Laundering (AML) In Insurance Industry In 2021, Financial Crime Academy, 2023

3: Money laundering in the insurance industry, Insurance Commission, 2022

4: Money laundering in the insurance industry, Atty. Dennis B. Funa, Business Mirror, 2016

[5]: Anti-Money Laundering Requirements: FAQs for Insurance Companies, FinCEN, 2005

This way, the money launderer can receive a legitimate payment from the insurance company, effectively washing the dirty money. This technique is also known as premium fraud or early surrender12 According to the Financial Crimes Enforcement Network (FinCEN), the most significant money laundering and terrorist financing risks in the insurance industry are found in life insurance and annuity products, because such products allow a customer to place largeamounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin34 Some indicators of potential money laundering through insurance products are: 12

* The customer pays the premiums with cash, cashier's checks, money orders, or other anonymous or unusual payment methods.

* The customer overpays the premiums or makes multiple payments in excess of the required amount.

* The customer cancels the policy during the free-look or grace period and requests a refund to a different account or a third party.

* The customer purchases a policy that is inconsistent with their income, age, or risk profile.

* The customer shows little interest in the benefits or terms of the policy, but is more concerned about the cancellation or surrender options.

:

1: AML in Insurance: How to Detect & Combat Money Laundering, ComplyAdvantage, 2022

2: Anti Money Laundering (AML) In Insurance Industry In 2021, Financial Crime Academy, 2023

3: Money laundering in the insurance industry, Insurance Commission, 2022

4: Money laundering in the insurance industry, Atty. Dennis B. Funa, Business Mirror, 2016

[5]: Anti-Money Laundering Requirements: FAQs for Insurance Companies, FinCEN, 2005

CAMS-CN Exam Question 60

哪一種私人銀行業務狀況需要根據沃爾夫斯堡集團的反洗錢原則實施盡職調查行動?

Correct Answer: C

this situation requires enhanced due diligence actions according to the AML principles of the Wolfsberg group. The Wolfsberg group is an association of 13 global banks that aims to develop standards and best practices for AML and CFT in the private banking sector. The group has issued a set of principles and guidance on how to conduct due diligence on private banking customers, especially those who pose higher risks, such as politically exposed persons (PEPs), customers from high-risk countries, and customers with complex or opaque structures. According to the Wolfsberg group, private banks should apply a risk-based approach to customer due diligence and perform enhanced measures for high-risk customers, such as obtaining senior management approval, verifying the identity and source of wealth of the customer and the beneficial owner, understanding the purpose and nature of the relationship, and conducting ongoing monitoring and review.

:

ACAMS Study Guide 6th Edition, Chapter 4, Section 4.5, page 118: "The Wolfsberg Group".

ExamTopics, Question 466: "Which private banking situation requires due diligence actions to be implemented according to the AML principles of the Wolfsberg group?"

:

ACAMS Study Guide 6th Edition, Chapter 4, Section 4.5, page 118: "The Wolfsberg Group".

ExamTopics, Question 466: "Which private banking situation requires due diligence actions to be implemented according to the AML principles of the Wolfsberg group?"

- Other Version

- 257ACAMS.CAMS-CN.v2026-01-03.q410

- 174ACAMS.CAMS-CN.v2025-12-05.q105

- 739ACAMS.CAMS-CN.v2024-10-09.q307

- Latest Upload

- 119SAP.C_BCBAI_2509.v2026-01-15.q13

- 188DAMA.DMF-1220.v2026-01-15.q271

- 138SAP.C_SIGDA_2403.v2026-01-15.q66

- 177ISACA.CRISC.v2026-01-15.q649

- 128PaloAltoNetworks.NetSec-Pro.v2026-01-15.q26

- 170Splunk.SPLK-1002.v2026-01-14.q121

- 170EMC.NCP-AII.v2026-01-14.q144

- 164Microsoft.AZ-800.v2026-01-13.q144

- 176Microsoft.MS-102.v2026-01-13.q258

- 121HP.HPE2-E84.v2026-01-13.q17

[×]

Download PDF File

Enter your email address to download ACAMS.CAMS-CN.v2025-11-29.q308 Practice Test