CFA-Level-I Exam Question 76

A trade deficit means:

I). The country does not save enough to fund its investment spending.

II). The country must reduce its net financial claims on the rest of the world.

III). There must be a capital account deficit.

I). The country does not save enough to fund its investment spending.

II). The country must reduce its net financial claims on the rest of the world.

III). There must be a capital account deficit.

CFA-Level-I Exam Question 77

A share of stock is expected to pay a dividend of $1.00 one year from now, with growth at 5% thereafter. In the context of a dividend discount model, the stock is correctly priced today at $10.

According to the single stage, constant growth dividend discount model, if the required return is 15%, the value of the stock two years from now should be:

According to the single stage, constant growth dividend discount model, if the required return is 15%, the value of the stock two years from now should be:

CFA-Level-I Exam Question 78

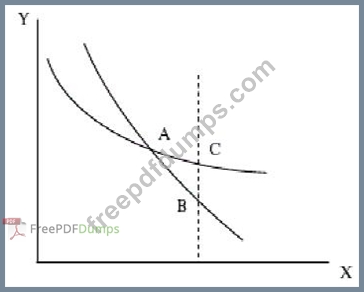

Indifference curves for one consumer never intersect. This comes from:

CFA-Level-I Exam Question 79

Multiple IRR are likely to appear when:

CFA-Level-I Exam Question 80

A small office building that recently sold for $175,000 generates annual net operating income of

$ 27,500. Using a 12% capitalization rate, how much NOI should a property generate under the income approach if the market value of the building is $195,000?

$ 27,500. Using a 12% capitalization rate, how much NOI should a property generate under the income approach if the market value of the building is $195,000?