CFA-Level-I Exam Question 86

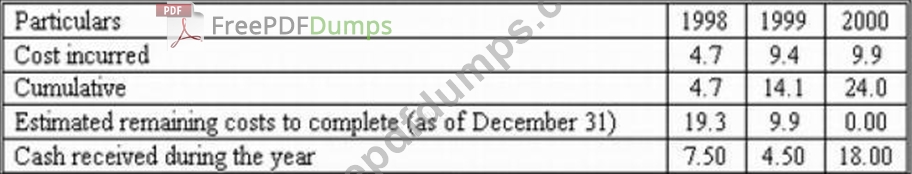

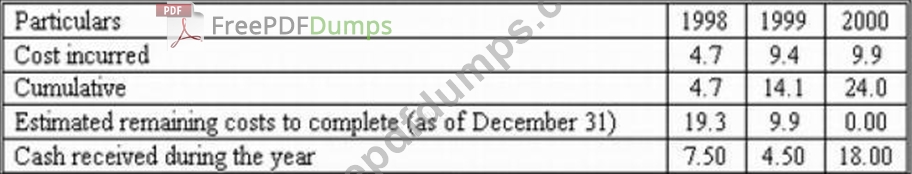

Merry Lucnhco Co., Corporation uses the percentage-of-completion method to recognize revenue. In

2 000, Merry Lucnhco Co., agreed to construct a facility at a total contract price of $28.0 million and a total expected cost of $24.0 million. Actual costs and cash inflow information are presented below (in

$ millions):

How much income did Merry Lucnhco Co., earn from the contract for years 1998, 1999, 2000 respectively?

2 000, Merry Lucnhco Co., agreed to construct a facility at a total contract price of $28.0 million and a total expected cost of $24.0 million. Actual costs and cash inflow information are presented below (in

$ millions):

How much income did Merry Lucnhco Co., earn from the contract for years 1998, 1999, 2000 respectively?

CFA-Level-I Exam Question 87

Under IFRS, an asset revaluation:

CFA-Level-I Exam Question 88

Which statement is false based on the real business cycle theory?

CFA-Level-I Exam Question 89

Suppose that four different portfolios have produced the following returns over the past year: 10%,

3 0%, 5% and 15%.

I). The mean return is 15%.

II). The range is 25%.

III). The mean absolute deviation is 7.5%.

2

IV). The variance is 87.5% .

V. The standard deviation is 9.354%.

Which statement(s) is/are FALSE?

3 0%, 5% and 15%.

I). The mean return is 15%.

II). The range is 25%.

III). The mean absolute deviation is 7.5%.

2

IV). The variance is 87.5% .

V. The standard deviation is 9.354%.

Which statement(s) is/are FALSE?

CFA-Level-I Exam Question 90

Two bonds issued by the same corporation have identical coupon rate, payment frequency, par value and time to maturity. The indenture of the first bond contains a call option, and the indenture of the second bond specifies a conversion privilege.