CFA-Level-I Exam Question 346

Which statement is FALSE?

CFA-Level-I Exam Question 347

An investor is currently considering the choice between a corporate and a municipal bond. The yield on these two bonds is given below.

Securities: Yield 10-year corporate bond: 6.43 10-year municipal bond: 5.20

The investor's marginal tax rate is 28%. What is the taxable equivalent yield on municipal bond?

Securities: Yield 10-year corporate bond: 6.43 10-year municipal bond: 5.20

The investor's marginal tax rate is 28%. What is the taxable equivalent yield on municipal bond?

CFA-Level-I Exam Question 348

The characteristics of an effective financial reporting framework do not include:

I). Relevance.

II). Transparency.

III). Reliability.

IV). Comprehensiveness.

V. Consistency.

I). Relevance.

II). Transparency.

III). Reliability.

IV). Comprehensiveness.

V. Consistency.

CFA-Level-I Exam Question 349

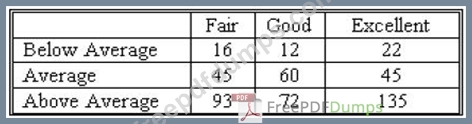

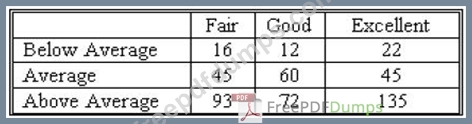

Each salesperson in a large department store chain is rated either below average, average, or above average with respect to sales ability. Each salesperson is also rated with respect to his or her potential for advancement either fair, good, or excellent.

These traits are the 500 salespeople were cross classified into the following table.

Sales Ability Potential for Advancement

What is the probability that a sales person selected at random will have below average sales abilityand fair potential for advancement?

These traits are the 500 salespeople were cross classified into the following table.

Sales Ability Potential for Advancement

What is the probability that a sales person selected at random will have below average sales abilityand fair potential for advancement?

CFA-Level-I Exam Question 350

Congratulations, you have won the lottery! Your prize is 50 payments of $200,000. The payments will be made at the end of each of the next 50 years. You plan to invest the payments at a rate of 7% per year.

What is the present value of your lottery prize?

What is the present value of your lottery prize?