F3 Exam Question 16

Company P is a large unlisted food-processing company.

Its current profit before interest and taxation is $4 million, which it expects to be maintainable in the future.

It has a $10 million long-term loan on which it pays interest of 10%.

Corporate tax is paid at the rate of 20%.

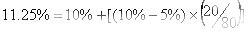

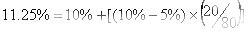

The following information on P/E multiples is available:

Which of the following is the best indication of the equity value of Company P?

Its current profit before interest and taxation is $4 million, which it expects to be maintainable in the future.

It has a $10 million long-term loan on which it pays interest of 10%.

Corporate tax is paid at the rate of 20%.

The following information on P/E multiples is available:

Which of the following is the best indication of the equity value of Company P?

F3 Exam Question 17

Company B is an all equity financed company with a cost of equity of 10%.

It is considering issuing bonds in order to achieve a gearing level of 20% debt and 80% equity.

These bonds will pay a coupon rate of 5% and have an interest yield of 6%.

Company B pays corporate tax at the rate of 25%.

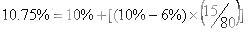

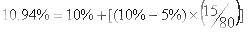

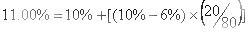

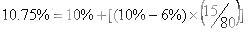

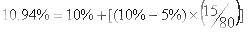

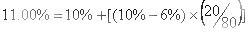

According to Modigliani and Miller's theory of capital structure with tax, what will be Company B's new cost of equity?

A)

B)

C)

D)

It is considering issuing bonds in order to achieve a gearing level of 20% debt and 80% equity.

These bonds will pay a coupon rate of 5% and have an interest yield of 6%.

Company B pays corporate tax at the rate of 25%.

According to Modigliani and Miller's theory of capital structure with tax, what will be Company B's new cost of equity?

A)

B)

C)

D)

F3 Exam Question 18

A is a listed company. Its shares trade on a stock market exhibiting semi-strong form efficiency.

Which of the following is most likely to increase the wealth of A's shareholders?

Which of the following is most likely to increase the wealth of A's shareholders?

F3 Exam Question 19

A company has some 7% coupon bonds in issue and wishes to change its interest rate profile.

It has decided to do this by entering into a plain coupon interest rate swap with it's bank.

The bank has quoted a swap rate of: 6.0% - 6.5% fixed against LIBOR.

What will the company's new interest rate profile be?

It has decided to do this by entering into a plain coupon interest rate swap with it's bank.

The bank has quoted a swap rate of: 6.0% - 6.5% fixed against LIBOR.

What will the company's new interest rate profile be?

F3 Exam Question 20

A company needs to raise $20 million to finance a project.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.