F3 Exam Question 26

A government is currently considering the privatisation of the national airline. The shares are to be offered to the public via a fixed price Initial Public Offering (IPO).

Which THREE of the following statements are correct?

Which THREE of the following statements are correct?

F3 Exam Question 27

Company A is planning to acquire Company B by means of a cash offer. The directors of Company B are prepared to recommend acceptance if a bid price can be agreed. Estimates of the net present value (NPV) of future cash flows for the two companies and the combined group post acquisition have been prepared by Company A's accountant. There are as follows:

What is the maximum price that Company A should offer for the shares in Company B?

Give your answer to the nearest $ million

What is the maximum price that Company A should offer for the shares in Company B?

Give your answer to the nearest $ million

F3 Exam Question 28

Company C has received an unwelcome takeover bid from Company P.

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

F3 Exam Question 29

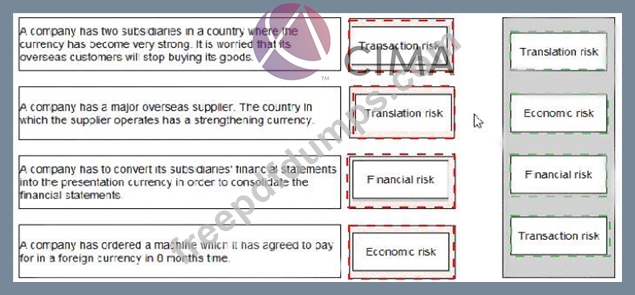

Select the category of risk for each of the descriptions below:

F3 Exam Question 30

A company has 8% convertible bonds in issue. The bonds are convertible in 3 years time at a ratio of 20 ordinary shares per $100 nominal value bond.

Each share:

* has a current market value of $5.60

* is expected to grow at 5% each year

What is the expected conversion value of each $100 nominal value bond in 3 years' time?

Each share:

* has a current market value of $5.60

* is expected to grow at 5% each year

What is the expected conversion value of each $100 nominal value bond in 3 years' time?