F3 Exam Question 1

A company enters into a floating rate borrowing with interest due every 12 months over the five year life of the borrowing.

At the same time, the company arranges an interest rate swap to swap the interest profile on the borrowing from floating to fixed rate.

These transactions are designated as a hedge for hedge accounting purposes under IAS 39 Financial Instruments: Recognition and Measurement.

Assuming the hedge is considered to be effective, how would the swap be accounted for 12 months later?

At the same time, the company arranges an interest rate swap to swap the interest profile on the borrowing from floating to fixed rate.

These transactions are designated as a hedge for hedge accounting purposes under IAS 39 Financial Instruments: Recognition and Measurement.

Assuming the hedge is considered to be effective, how would the swap be accounted for 12 months later?

F3 Exam Question 2

Company U has made a bid for the entire share capital of Company B.

Company U is offering the shareholders in Company B the option of either a share exchange or a cash alternative.

Advise the shareholders in Company B which THREE of the following would be considered disadvantages of accepting the cash consideration?

Company U is offering the shareholders in Company B the option of either a share exchange or a cash alternative.

Advise the shareholders in Company B which THREE of the following would be considered disadvantages of accepting the cash consideration?

F3 Exam Question 3

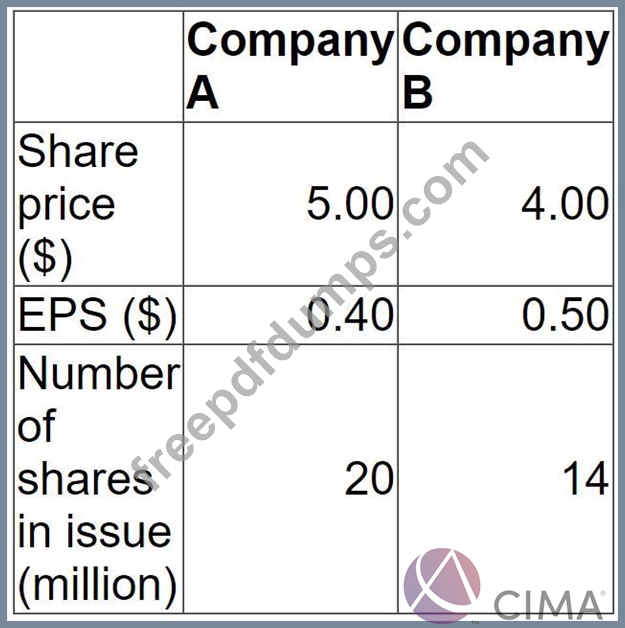

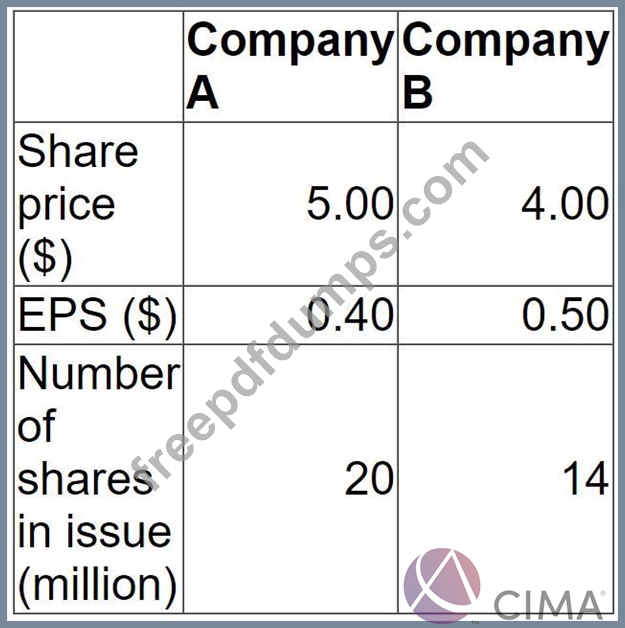

Company A is planning to acquire Company B at a price of $ 65 million by means of a cash bid.

Company A is confident that the merged entity can achieve the same price earnings ratio as that of Company A.

What does Company A expect the value of the merged entity to be post acquisition?

Company A is confident that the merged entity can achieve the same price earnings ratio as that of Company A.

What does Company A expect the value of the merged entity to be post acquisition?

F3 Exam Question 4

Two listed companies in the same industry are joining together through a merger.

What are the likely outcomes that will occur after the merger has happened?

Select ALL that apply.

What are the likely outcomes that will occur after the merger has happened?

Select ALL that apply.

F3 Exam Question 5

A product costs USD10 when purchased in the USA. The same product costs USD12 when it is purchased in the UK and the price in GBP is convened to USD.

Which of the following statement concerning purchasing power parity is correct?

Which of the following statement concerning purchasing power parity is correct?