2016-FRR Exam Question 41

Bank Milo has $4 million in cash and $5 million in loans coming due tomorrow with an expected default rate

of 1%. The proceeds will be deposited overnight. The bank owes $ 9 million on a securities purchase that

settles in two days and pays off $8 million in commercial paper in three days that is not expected to renew. On

what days does the bank face negative cumulative liquidity?

of 1%. The proceeds will be deposited overnight. The bank owes $ 9 million on a securities purchase that

settles in two days and pays off $8 million in commercial paper in three days that is not expected to renew. On

what days does the bank face negative cumulative liquidity?

2016-FRR Exam Question 42

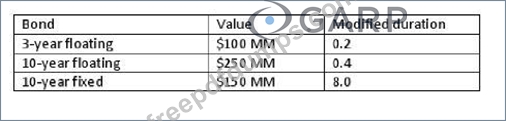

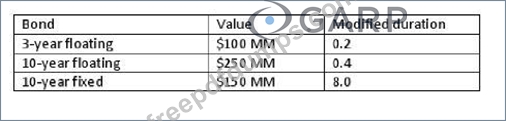

A portfolio consists of two floating rate bonds and one fixed rate bond.

Based on the information below, modified duration of this portfolio is

Based on the information below, modified duration of this portfolio is

2016-FRR Exam Question 43

Which one of the following four option types has two strike prices?

2016-FRR Exam Question 44

Gamma Bank provides a $100,000 loan to Big Bath retail stores at 5% interest rate (paid annually). The loan is

collateralized with $55,000. The loan also has an annual expected default rate of 2%, and loss given default at

50%. In this case, what will the bank's exposure at default (EAD) be?

collateralized with $55,000. The loan also has an annual expected default rate of 2%, and loss given default at

50%. In this case, what will the bank's exposure at default (EAD) be?

2016-FRR Exam Question 45

Which one of the following four statements on factors affecting the value of options is correct?