2016-FRR Exam Question 121

Which one of the following four options correctly identifies the core difference between bonds and loans?

2016-FRR Exam Question 122

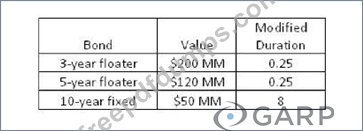

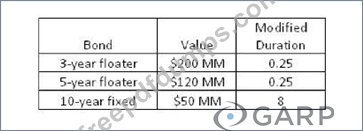

A bank owns a portfolio of bonds whose composition is shown below.

What is the modified duration of the portfolio?

What is the modified duration of the portfolio?

2016-FRR Exam Question 123

James Johnson manages a bond portfolio with all investment grade bonds. Adding which of the following

bonds would minimize the credit risk of his portfolio?

bonds would minimize the credit risk of his portfolio?

2016-FRR Exam Question 124

A risk associate evaluating his current portfolio of assets and liabilities wants to determine how sensitive this

portfolio is to changes in interest rates. Which one of the following four metrics is typically used for this

purpose?

portfolio is to changes in interest rates. Which one of the following four metrics is typically used for this

purpose?

2016-FRR Exam Question 125

Jack Richardson wants to compute the 1-month VaR of a portfolio with a market value of USD 10 million,

with an average monthly return of 1% and average monthly standard deviation of 1.5%. What is the portfolio

VaR at 99% confidence level?

Probability Cumulative Normal distribution

0.90 1.282

0.91 1.341

0.92 1.405

0.93 1.476

0.94 1.555

0.95 1.645

0.96 1.751

0.97 1.881

0.98 2.054

0.99 2.326

with an average monthly return of 1% and average monthly standard deviation of 1.5%. What is the portfolio

VaR at 99% confidence level?

Probability Cumulative Normal distribution

0.90 1.282

0.91 1.341

0.92 1.405

0.93 1.476

0.94 1.555

0.95 1.645

0.96 1.751

0.97 1.881

0.98 2.054

0.99 2.326