CMA-Strategic-Financial-Management Exam Question 1

A company is considering a capital project that includes the purchase of a new machine costing $100,000. The machines estimated useful life is five years with no salvage value. The annual operating cash inflows from the project are shown below.

Given an effective income tax rate of 20% and using straight-line depreciation, what would be the projects net cash flow in Year 3?

Given an effective income tax rate of 20% and using straight-line depreciation, what would be the projects net cash flow in Year 3?

CMA-Strategic-Financial-Management Exam Question 2

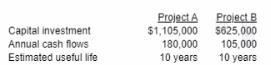

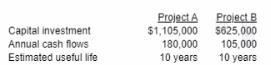

A company has hired a consultant to propose a way to increase the company's revenues. The consultant has evaluated two mutually exclusive projects with me following information provided for each project.

The company uses a discount rate of 9% to evaluate both projects Based on the net present value, the company should invest in

The company uses a discount rate of 9% to evaluate both projects Based on the net present value, the company should invest in

CMA-Strategic-Financial-Management Exam Question 3

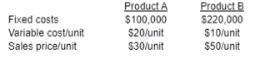

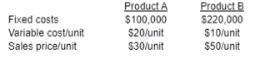

London Corporation has in the following cost structure for two of its product.

Assume that me current sales level is 15,000 units of Product A and 5,000 units of Product B Using cost-volume-profit analysis which of the following courses of action would maximize profit in the short term?

Assume that fixed costs are sunk costs in the short term.

Assume that me current sales level is 15,000 units of Product A and 5,000 units of Product B Using cost-volume-profit analysis which of the following courses of action would maximize profit in the short term?

Assume that fixed costs are sunk costs in the short term.

CMA-Strategic-Financial-Management Exam Question 4

Below is the income statement and balance sheet for a retail corporation.

What is the corporation's return on equity in Year 2?

What is the corporation's return on equity in Year 2?

CMA-Strategic-Financial-Management Exam Question 5

Identify the market structure in which OLI operates and explain how OLi's pricing is affected by this mantel structure Essay Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country.

It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is

€300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.

It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is

€300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.