CMA-Strategic-Financial-Management Exam Question 16

K Malone is a successful entrepreneur, Currently she is considering investing in a capital protect, which would benefit tourism in North Caroina Because of tourism, the State of North Carolina is willing to lent) her

$150,000 at a rate of 5%. well below the market rate Her estimated net cash flows for the 3-year lifetime of the project are S15 000 $89,000 and $60,000 respectively Recommend whether or not Malone should undertake this project.

$150,000 at a rate of 5%. well below the market rate Her estimated net cash flows for the 3-year lifetime of the project are S15 000 $89,000 and $60,000 respectively Recommend whether or not Malone should undertake this project.

CMA-Strategic-Financial-Management Exam Question 17

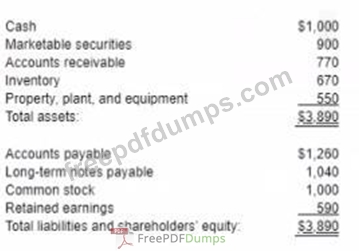

A company's balance sheet information at the end of July is shown below (in$000s).

What is the company's financial leverage ratio?

What is the company's financial leverage ratio?

CMA-Strategic-Financial-Management Exam Question 18

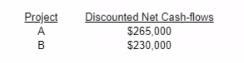

Southwest Supplies Inc. (SSI) is considering the following two projects with cash-flows discounted at SSI's weighted average cost of capital.

SSI can only afford to invest in one of the projects. Which statement would most likely explain why SSI would choose Project B over project A?

SSI can only afford to invest in one of the projects. Which statement would most likely explain why SSI would choose Project B over project A?

CMA-Strategic-Financial-Management Exam Question 19

Alliantz Company, a USA-based manufacturer needs to set up a hedge to protect against dollar exchange rate devaluation. The protection is necessary (or an open balance of $2 478.450 Payment is to be settled in a rare currency 40 days from today excluding transaction fees which investment instrument would be used to provide the best hedge?

CMA-Strategic-Financial-Management Exam Question 20

Given the financial information shown below, what amounts would be shown for sales revenue and for gross prom, respectively in a common size income statement?