GLO_CWM_LVL_1 Exam Question 266

A trust is created by a son, the Settlor, for the survival expenses of his retired parents each having equal beneficial interest. Both husband and wife have separate fixed pension of Rs.35,000 per month and Rs. 20,000 per month, respectively. The trust property has generated a net annual value of Rs. 5.12 lakh in the previous year 2012-13. The trustee as well as the Settlor is in the 30% tax bracket. Find the tax payable by the trustee as representative assessee.

GLO_CWM_LVL_1 Exam Question 267

What is burn Arbun?

GLO_CWM_LVL_1 Exam Question 268

Foreign currency borrowings raised by Indian corporate from outside India are called

GLO_CWM_LVL_1 Exam Question 269

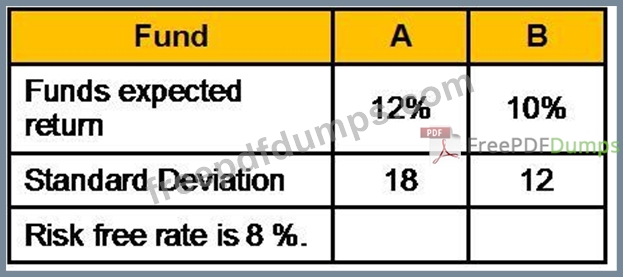

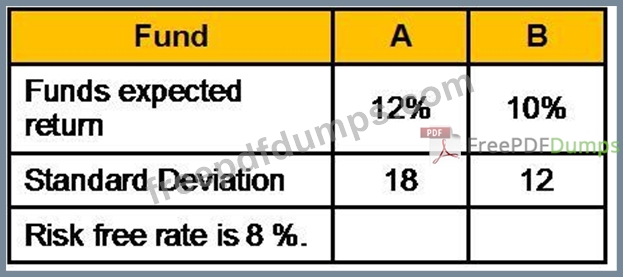

The following parameters are available for two mutual funds:

Calculate Sharpe measure?

Calculate Sharpe measure?

GLO_CWM_LVL_1 Exam Question 270

Which of the following can be described as involving direct finance?