GLO_CWM_LVL_1 Exam Question 271

Management has recently announced that expected dividends for the next three years will be as follows:

For the subsequent years, management expects the dividend to grow at 5% annually. If the risk-free rate is

4.30%, the return on the market is 10.30% and the firm's beta is 1.40. What is the maximum price that you should pay for this stock?

For the subsequent years, management expects the dividend to grow at 5% annually. If the risk-free rate is

4.30%, the return on the market is 10.30% and the firm's beta is 1.40. What is the maximum price that you should pay for this stock?

GLO_CWM_LVL_1 Exam Question 272

Which of the following options is not true about CODICIL?

GLO_CWM_LVL_1 Exam Question 273

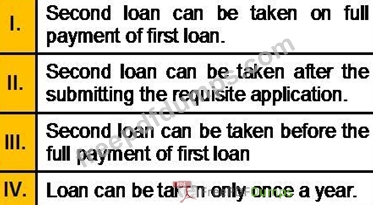

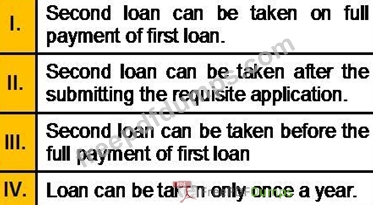

Which of following statement is/are true in relation to PPF account?

GLO_CWM_LVL_1 Exam Question 274

If an investor is bearish on a share, buying a put is usually better then selling short because:

GLO_CWM_LVL_1 Exam Question 275

Mr. Munjal has got her daughters son admitted to a dental college today, where he has to pay a fee of Rs. 1.5 Lac today i.e. at the time of admission. Then Rs. 1.75 lacs after 1 year, Rs. 2.5 lacs after 2 years and Rs. 3.25 lacs after 3 years. He wants to set aside the amount required today itself in the form of a Bank FDR.So how much he needs to put aside today if ROI is 8% for 1 year, 8.5% for 2 years and 9% for 3 years, all compounded Quarterly?