CFA-Level-I Exam Question 191

The probability that events A and B do not occur simultaneously equals 0.77. The probability of neither A nor B occurring equals 0.38. If P(A) equals 0.26, the probability of B occurring equals ________.

CFA-Level-I Exam Question 192

An auto manufacturer is conducting a market study for a new model. It is afraid that the new car may cannibalize sales from its existing lineup. The sales director thinks that based on past experience, as much as 20% or more of existing buyers would move to the new model. The market research department is setting up the null hypothesis to test the effect of the new model on existing model sales. If u represents the erosion of sales of the current model, which of the following is the most appropriate null hypothesis?

CFA-Level-I Exam Question 193

A portfolio consists of 2 bonds:Bond | Maturity | Coupon | Duration | Proportion in Portfolio

Bond A | 10 years | 8% | 6.7 | 60% Bond B | 7 years | 5.2% |3.9 | 40%

If there is an upward parallel shift in yields by 61 basis points, what will be percentage change in the portfolio value?

Bond A | 10 years | 8% | 6.7 | 60% Bond B | 7 years | 5.2% |3.9 | 40%

If there is an upward parallel shift in yields by 61 basis points, what will be percentage change in the portfolio value?

CFA-Level-I Exam Question 194

A firm's short-run cost curves will shift upward if there is a

CFA-Level-I Exam Question 195

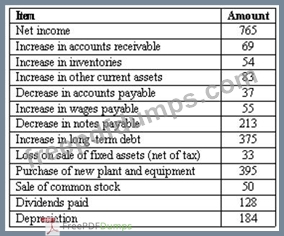

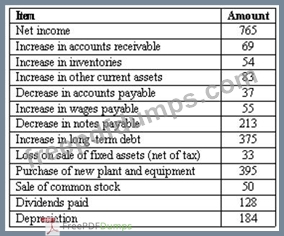

A financial analyst has gathered the following information from balance sheet and income statement of a company:

What is the cash flow from operations?

What is the cash flow from operations?