F1 Exam Question 21

Which of the following would NOT be assessed for tax under a Pay-As-You-Earn system?

F1 Exam Question 22

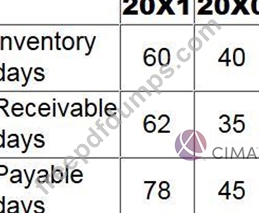

PZ has the following working capital ratios:

Which of the following could be the reason for the movements?

Which of the following could be the reason for the movements?

F1 Exam Question 23

In accordance with IFRS 3 Business Combinations, acquisition accounting of an investment in another entity within the consolidated statement of financial position means that the:

F1 Exam Question 24

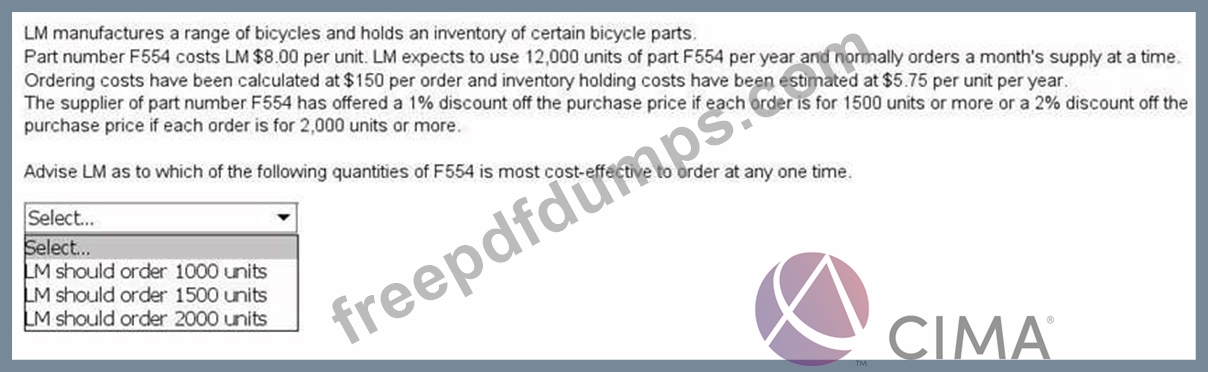

F1 Exam Question 25

ST has an asset that was classified as held for sale at 30 June 20X4. The asset's carrying value was

$230,000 and its fair value $210,000.

The cost of disposal was estimated to be $15,000.

In accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations, which of the following values should be used for the asset in the statement of financial position as at 30 June 20X4?

$230,000 and its fair value $210,000.

The cost of disposal was estimated to be $15,000.

In accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations, which of the following values should be used for the asset in the statement of financial position as at 30 June 20X4?