F1 Exam Question 41

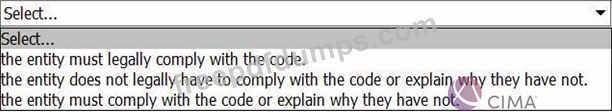

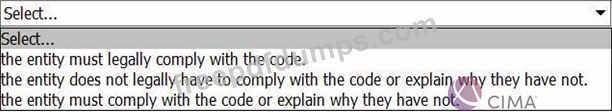

The United Kingdom (UK) uses a principle based approach to corporate governance which means:

F1 Exam Question 42

If a parent entity is to be exempt from preparing consolidated financial statements it needs to satisfy certain conditions according to IFRS 10 Consolidated Financial Statements.

Which TWO of the following are conditions that need to be satisfied to be exempt?

Which TWO of the following are conditions that need to be satisfied to be exempt?

F1 Exam Question 43

The tax rules in a country state that all tax returns must be filed by 31 March each year and that any outstanding tax balance must be paid by 14 April each year. An entity filed its tax return on 10 April

20X2 and paid the outstanding tax on 20 April 20X2.

Which TWO of the following powers is the tax authority likely to have in respect of these actions by the entity?

20X2 and paid the outstanding tax on 20 April 20X2.

Which TWO of the following powers is the tax authority likely to have in respect of these actions by the entity?

F1 Exam Question 44

Which of the following is a feature of a direct tax?

F1 Exam Question 45

XYZ operates in Country P where the tax rules state entertaining costs and accounting depreciation are disallowable for tax purposes.

In year ending 31 March 20X4, XYZ made an accounting profit of $240,000.

Profit included $14,500 of entertaining costs and $5,000 of income exempt from taxation.

XYZ has plant and machinery with accounting depreciation amounting to $26,300 and tax depreciation amounting to $35,200.

Calculate the taxable profit for the year ended 31 March 20X4.

In year ending 31 March 20X4, XYZ made an accounting profit of $240,000.

Profit included $14,500 of entertaining costs and $5,000 of income exempt from taxation.

XYZ has plant and machinery with accounting depreciation amounting to $26,300 and tax depreciation amounting to $35,200.

Calculate the taxable profit for the year ended 31 March 20X4.