F1 Exam Question 36

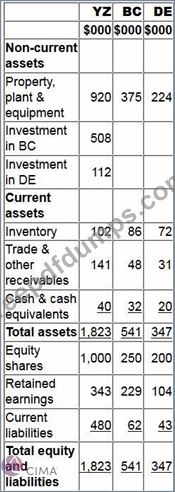

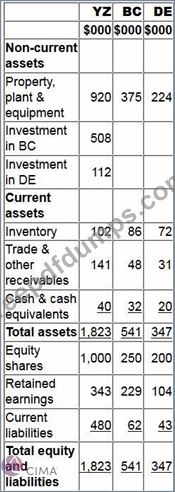

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April

20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the amount of the non-controlling interest to be included in YZ's consolidated statement of financial position at 31 March 20X2.

Give your answer to the nearest whole $.

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April

20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the amount of the non-controlling interest to be included in YZ's consolidated statement of financial position at 31 March 20X2.

Give your answer to the nearest whole $.

F1 Exam Question 37

GH's tax liability at 30 June 20X3 in respect of the tax charge on the profits for the year ended 30 June

20X3 is $876,000.

There was an over provision of $105,000 that related to the tax charge on the profits for the year ending

30 June 20X2.

What amount should be shown in GH's statement of profit or loss for the year ending 30 June 20X3?

Give your answer to the nearest $.

20X3 is $876,000.

There was an over provision of $105,000 that related to the tax charge on the profits for the year ending

30 June 20X2.

What amount should be shown in GH's statement of profit or loss for the year ending 30 June 20X3?

Give your answer to the nearest $.

F1 Exam Question 38

AAA has the following working capital ratios at 30 March 20X4:

During the year ended 30 March 20X4 credit purchases were $3,600 and at 30 March 20X4 the outstanding trade payables amounted to $522.

The year ended 30 March 20X4 was not a leap year.

Calculate the working capital cycle for AAA.

Give your answer to one decimal place.

During the year ended 30 March 20X4 credit purchases were $3,600 and at 30 March 20X4 the outstanding trade payables amounted to $522.

The year ended 30 March 20X4 was not a leap year.

Calculate the working capital cycle for AAA.

Give your answer to one decimal place.

F1 Exam Question 39

Which of the following is the responsibility of the International Financial Reporting Standards Interpretations Committee?

F1 Exam Question 40

The following information relates to ABC.

Which of the following would be a reason for the movement in the trade receivable days?

Which of the following would be a reason for the movement in the trade receivable days?