F1 Exam Question 51

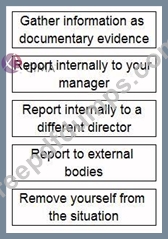

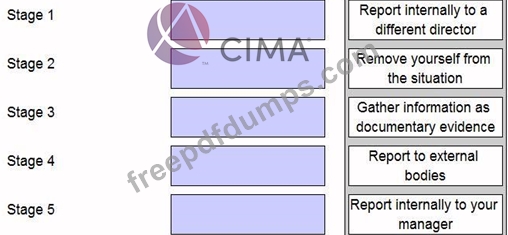

You work in the finance department of an entity. A director has approached you and asked you to falsify sales invoices which would significantly inflate revenue. The CIMA Code of Ethics suggests that you should deal with such an ethical dilemma by following a number of stages.

Place each of the stages identified below into chronological order.

Place each of the stages identified below into chronological order.

F1 Exam Question 52

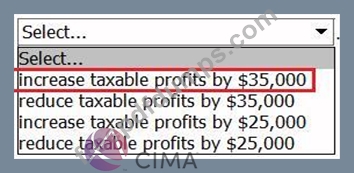

AB sells to ST, a group entity, 10,000 units at $2.50 each. The market value was $6 each.

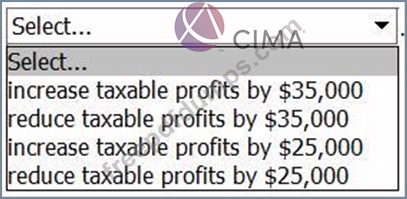

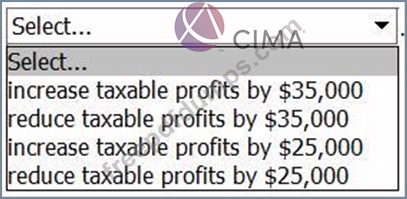

The effect on AB of the transfer pricing legislation on this transaction would be to: .

The effect on AB of the transfer pricing legislation on this transaction would be to: .

F1 Exam Question 53

An entity has a number of subsidiary and associate investments.

Which of the following must be disclosed in the entity's separate financial statements if it is exempt from presenting consolidated financial statements?

Which of the following must be disclosed in the entity's separate financial statements if it is exempt from presenting consolidated financial statements?

F1 Exam Question 54

A building was purchased on 1 January 20X1 for $300,000 and had a useful economic life of 40 years. On

1 January 20X5 the building was revalued by a professional surveyor at $450,000. Directors decided to incorporate the revalued amount into the financial statements.

The accounting entries to record the initial revaluation of the building in the financial statements for the year ended 31 December 20X5 will be to debit building cost $150,000 and then:

1 January 20X5 the building was revalued by a professional surveyor at $450,000. Directors decided to incorporate the revalued amount into the financial statements.

The accounting entries to record the initial revaluation of the building in the financial statements for the year ended 31 December 20X5 will be to debit building cost $150,000 and then:

F1 Exam Question 55

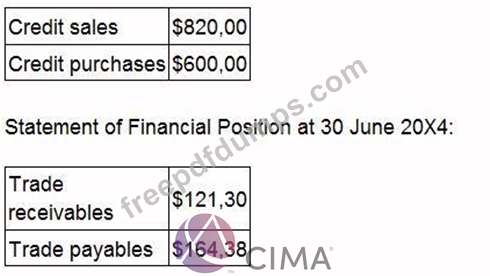

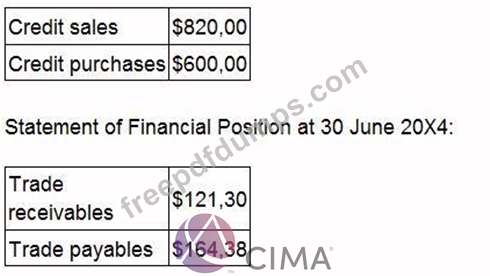

The following data relates to Company AB.

Statement of Profit or Loss for the year ended 30 June 20X4:

During the year ending 30 June 20X4, which was not a leap year, the average stock holding period was

102 days.

Calculate the working capital cycle in days.

Give your answer to the nearest full day.

Statement of Profit or Loss for the year ended 30 June 20X4:

During the year ending 30 June 20X4, which was not a leap year, the average stock holding period was

102 days.

Calculate the working capital cycle in days.

Give your answer to the nearest full day.