F1 Exam Question 61

Which of the following is NOT a primary need for regulating financial reporting information of incorporated entities?

F1 Exam Question 62

Which THREE of the following are principles identified by the Code of Ethics?

F1 Exam Question 63

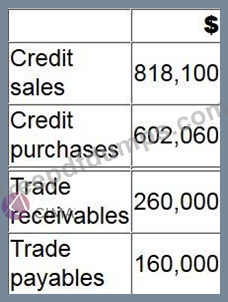

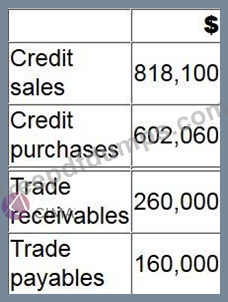

An entity has a working capital cycle of 120 days which has been calculated in part from the following data:

What is the stock holding period on the basis of 365 days in a year?

Give your answer to the nearest whole day.

What is the stock holding period on the basis of 365 days in a year?

Give your answer to the nearest whole day.

F1 Exam Question 64

An entity had a current tax liability of $187,000 in its statement of financial position as at 30 September

20X5. It was subsequently negotiated and eventually agreed with the tax authorities that the entity would pay $192,000 and this was paid on 6 January 20X6.

The entity's management estimate that the tax due on profits for the year to 30 September 20X6 is

$231,000.

Calculate the entity's corporate income tax expense included in its statement of profit or loss for the year ended 30 September 20X6.

Give your answer to the nearest whole $000.

20X5. It was subsequently negotiated and eventually agreed with the tax authorities that the entity would pay $192,000 and this was paid on 6 January 20X6.

The entity's management estimate that the tax due on profits for the year to 30 September 20X6 is

$231,000.

Calculate the entity's corporate income tax expense included in its statement of profit or loss for the year ended 30 September 20X6.

Give your answer to the nearest whole $000.

F1 Exam Question 65

The International Accounting Standards Board's "The Conceptual Framework for Financial Reporting" identifies fundamental and enhancing qualitative characteristics of financial statements.

Which of the following is included within the fundamental characteristics?

Which of the following is included within the fundamental characteristics?